Investment Banks

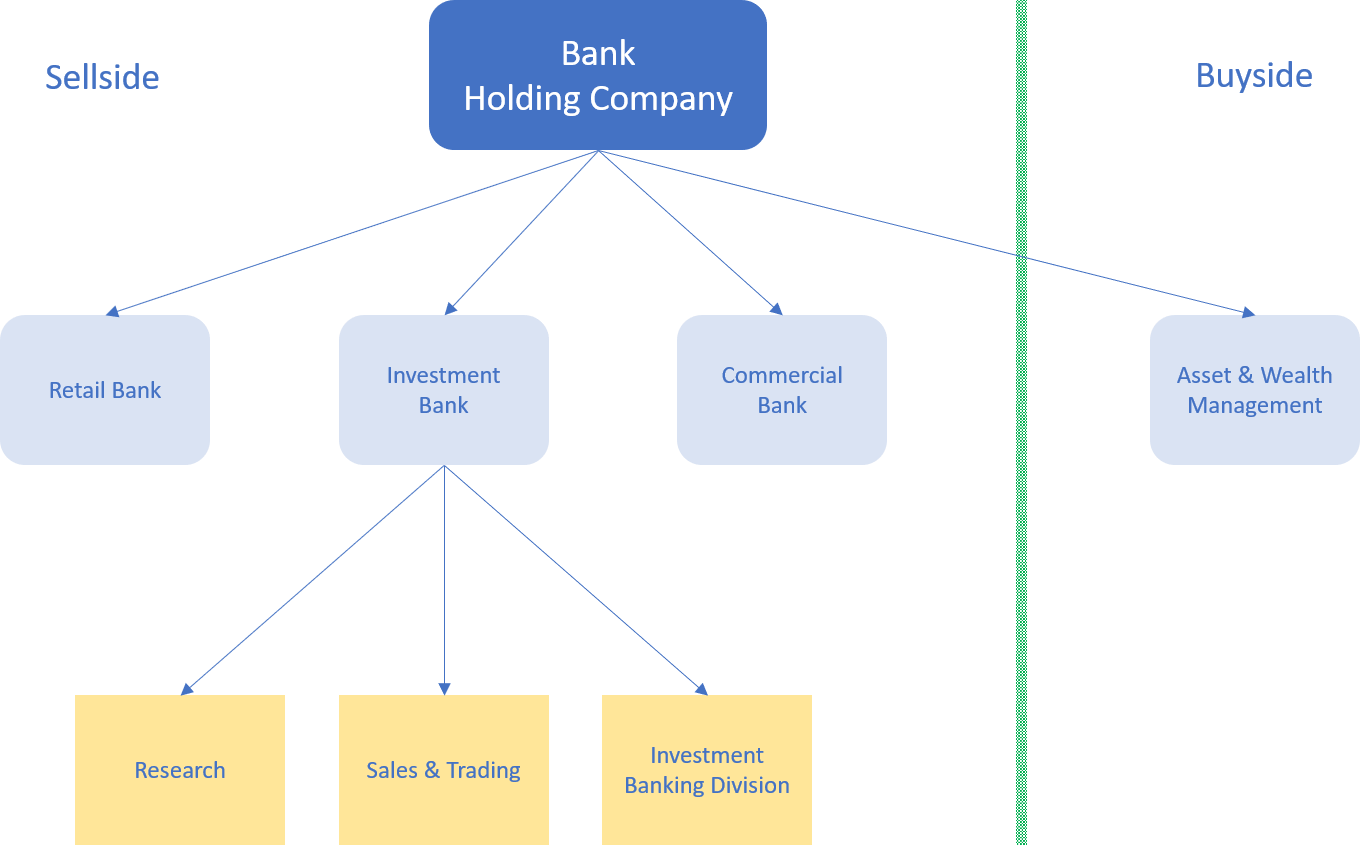

Investment banks form the core of the services that the sellside provides to the buyside and corporations. Investment banks themselves include several divisions, and can be standalone like Goldman Sachs and Morgan Stanley, or part of a bank holding company like J.P. Morgan. Below are the four main divisions often found at prominent investment banks.

Sales & Trading

This division of an investment bank functions to provide liquidity and execute trades for big institutional investors. Let’s say a fund at Vanguard tries to buy 100,000 shares of Apple stock (AAPL). It is relatively easy for mom and pop to buy 100 shares of AAPL on their personal brokerage account, but a trade size that large will need some assistance to execute to get the best price without affecting the market too much. The fund could use a mixture of electronic trading and broker trading to find a balance between lowering commission cost and finding the best price. The trader, when he (she) gets that order, will either execute it by selling from his own book of positions if he holds the stock, or contact another or several brokers who are looking to sell that stock.

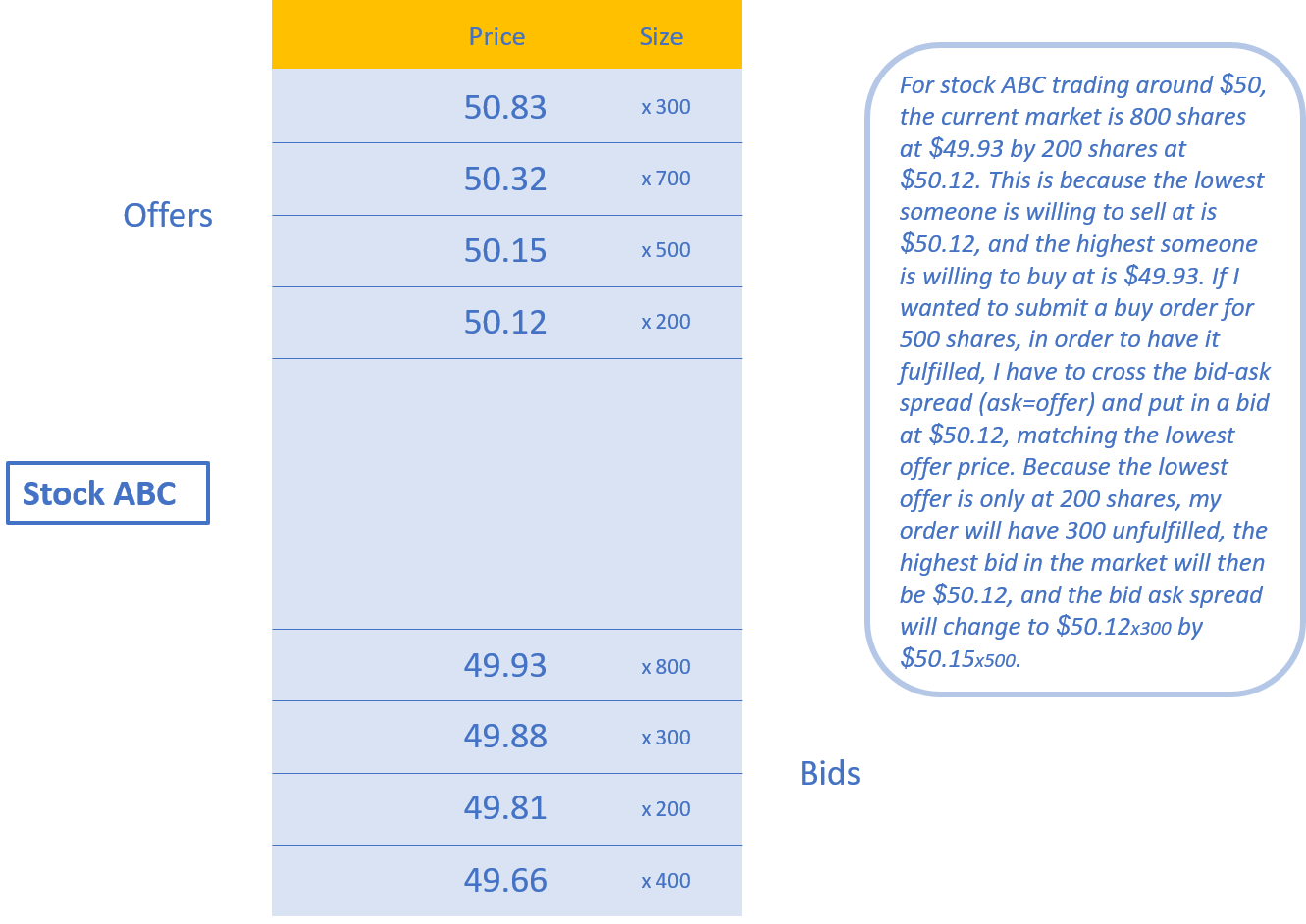

Liquidity, mentioned earlier, is the reliability of price when one is trying to buy or sell something. Think of the market as a two-sided auction with buyers placing bids (prices they willing to buy at) and sellers placing offers (prices they are willing to sell at). The offer is usually higher than the bid, and the gap is called the spread. When a buyer is willing to raise his bid to match the offer, the two sides agree on price and a trade is done. When a seller is willing to lower his offer to match the bid, the two sides agree on price and a trade is done. When fewer shares are traded over a given timeframe, there are fewer participants on each side and the bid-ask spread is wider, meaning the price is less reliable, and the market or security is less liquid. When more shares are traded over a given timeframe, there are more participants on either side, and the bid-ask spread is narrower, meaning the price is more reliable, and the market or security is more liquid. Liquidity can also describe other assets: houses are illiquid, oil and gold are liquid, cash is very liquid, bonds vary.

Research

Sellside research at investment banks consists of analysts that publish research on companies for the public to have access to. They issue recommendations and provide contextual information on the companies that they cover. Analysts are often grouped by industry, so one analyst may cover biotechnology companies while another covers media companies. They often have connections to the management of companies they cover, and engage on the conference calls of quarterly earnings releases. They are not allowed to disclose, and should not have access to Material Nonpublic Information (important info that should not be available to the public). Sellside analysts publish their research to the public compared to buyside analysts who keep their research in-house so their buyside firms don’t reveal strategy secrets.

Mergers & Acquisitions (M&A) Advisory

Sometimes after companies get to a certain stage in their growth, it becomes hard to innovate. This means that they have an option to buy another company with a complementary business to help drive earnings growth, new ideas, or save costs. When a company decides that this is the route it wants to take, it can hire investment bankers as advisors to the merger deal. The bankers put up valuation models to help estimate what price the acquiring company should pay for the target company, as well as serve as representatives to other parties involved. The target company also hires bankers as advisers for the deal to help it with valuation and correspondence.

Leveraged Finance

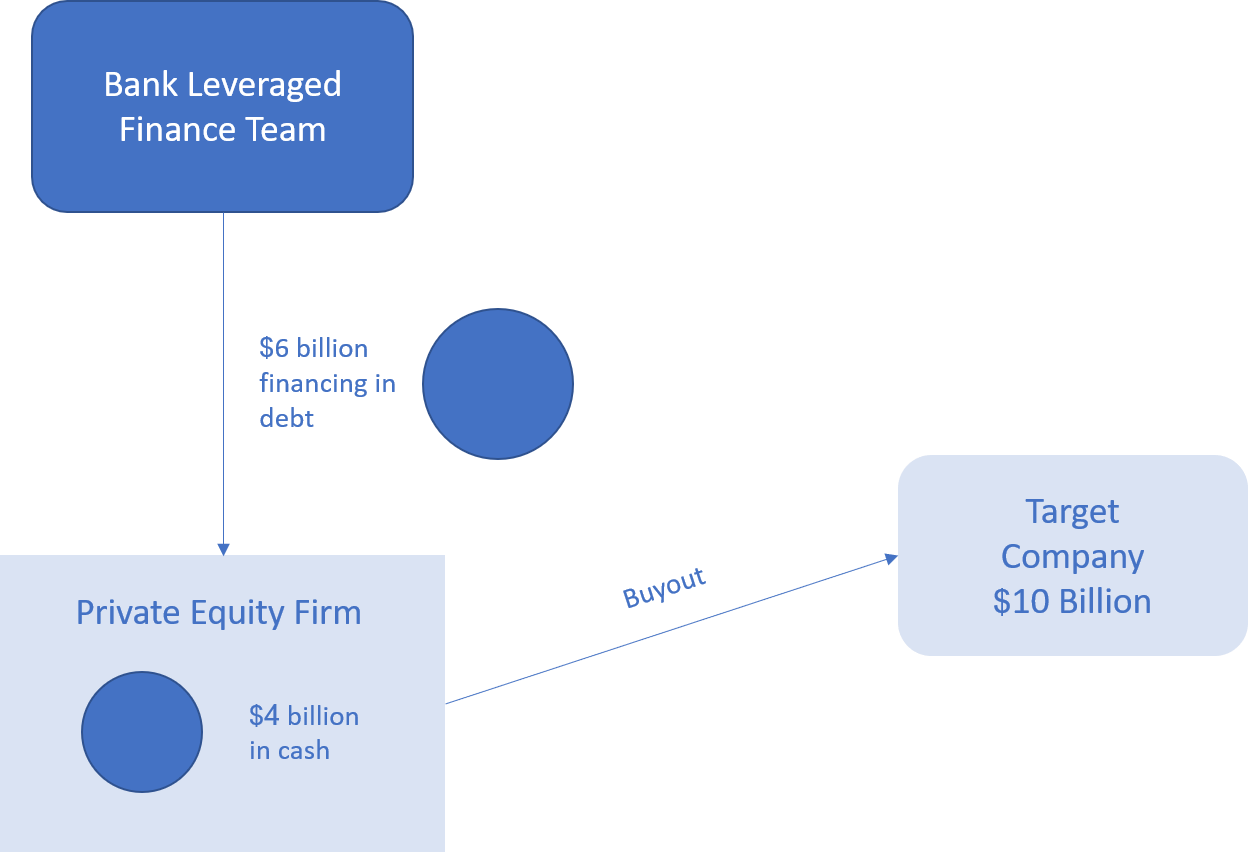

Certain buyside participants use leverage in their investment strategies. Hedge funds and PE funds often use leverage in the form of loans from investment banks to finance their purchases of companies. Indicative of its name, PE funds usually take equity stakes in private companies as opposed to public companies - although it’s also possible to acquire a complete equity stake in a public company and then take it private. Leveraged Finance also applies to providing financing for companies that are acquiring other companies in the form of loans.

IPOs and Secondary Offerings

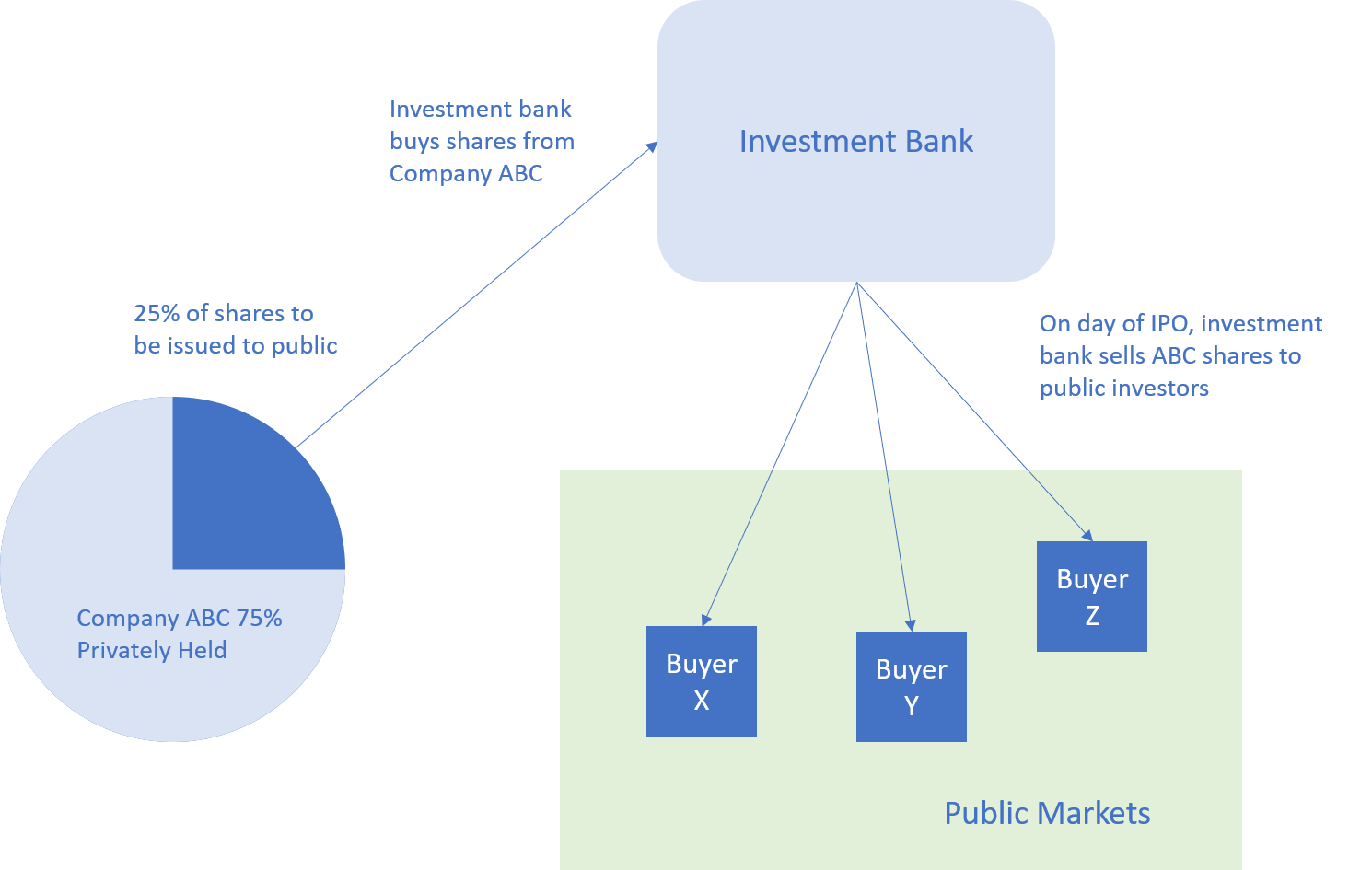

Initial Public Offerings or IPOs take place when a company first decides to raise money from public markets. Companies first start out as privately owned by the founders, and as owners/managers grow the company, they need more funding. At a certain point, the company may decide that it wants to raise funding by from public markets as opposed to private investors. For example, a company that wants to raise funding of $20 million for 10% of shares would value it at $200 million. That 10% of shares would then trade in public markets. Investment bankers, through the bank’s connections to institutional buyers, help those companies access the public markets. They help value the company for the IPO, contact their buyside connections to gauge investor interest, and eventually assist in the process of actually delivering the shares to public investors. Secondary offerings occur when a company, already public, wishes to raise more funding. Bonds are underwritten in a similar way to equities. Companies are just issuing bonds instead of shares, and these bonds are still bought by banks who then distribute them to public buyers.

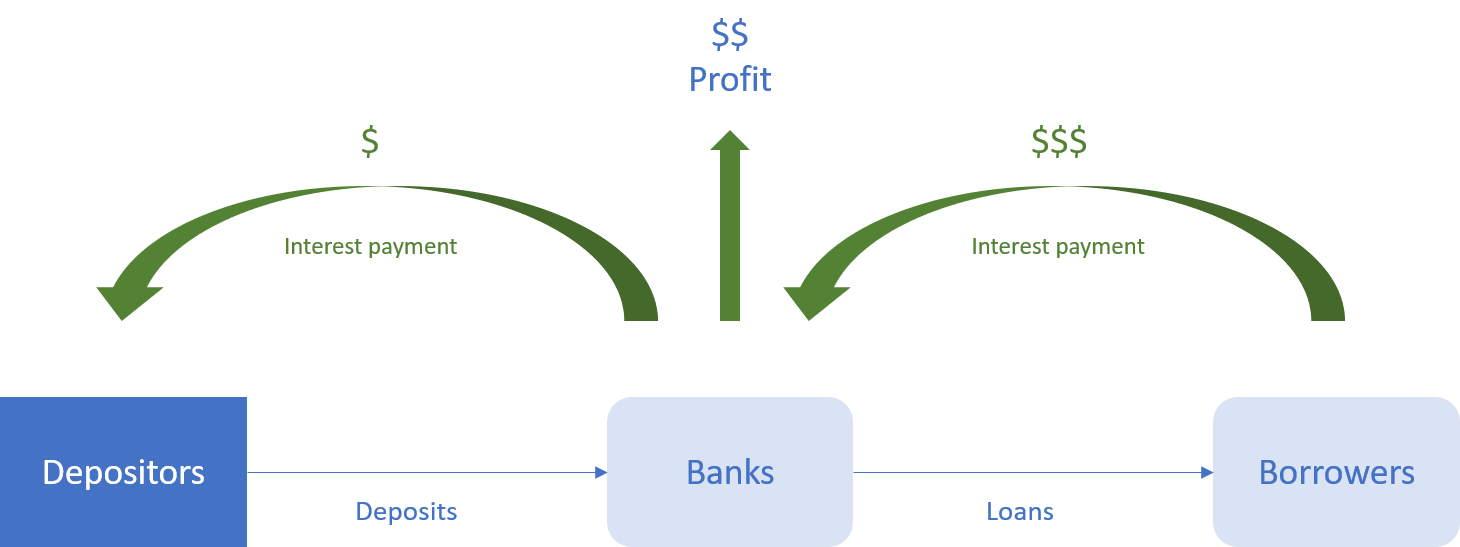

Commercial Banks

At the core of banking institutions, deposits and lending is the age old business of banks. Consumers and corporations need places to park their cash, and bank accounts are what they use. The primary business of commercial banks is accepting deposits from individuals and corporations and lending them back out as loans, generating profits when the interest received from loans outstanding are higher than the interest the bank is paying to its depositing customers. Commercial banks are secured by the FDIC, as opposed non-deposit accounts at investment institutions. Note that different banks actually label their divisions differently - some banks will use “corporate” and “commercial” interchangeably which can get confusing. For simplicity’s sake, from here on out, we will refer to a commercial bank as a bank servicing businesses of all sizes, large and small.

Retail Banks

We have gone over services to the buyside and corporations, but retail banks are about the consumer. Its goal is to provide a host of services such as savings accounts, checking accounts, personal loans, credit cards, mortgages, etc so that the consumer has access to the important financial innovations that make our lives easier. Retail banking and commercial banking operations are interlinked. For example, retail services to clients occur at the physical local branches of commercial banks. From now on, we will refer to retail banks as a bank servicing individual consumers.

Review

Below is a diagram summarizing the structure and organization of a typical bank holding company. The business segments retail bank, investment bank, commercial bank, and asset management may each exist independently. The largest banks typically have combinations of these business segments into a bank holding company.