Hierarchy

IBD and S&T

Before delving into the nitty gritty of what goes on inside investment banks, we need to briefly review a general hierarchy of employees. For each team, there are generally 5 levels of seniority with #5 being the most senior. We will go into more details later of what each role does depending on the team they are working on.

- Analyst

- Associate

- Vice President

- Executive Director

- Managing Director

Employees more senior than managing director will start having titles that vary based on the division of the bank, and how each bank decides to structure its teams. For now, we will focus on the people an entry level employee would most likely interact with on a day to day basis.

Research

In research, the terminology is a bit flipped. There are mainly just two roles: Associate and Analyst. Here, analyst is the more senior title and the one that does more noteworthy research reports. The associate helps the senior analyst cover companies and may start building his/her own list of companies.

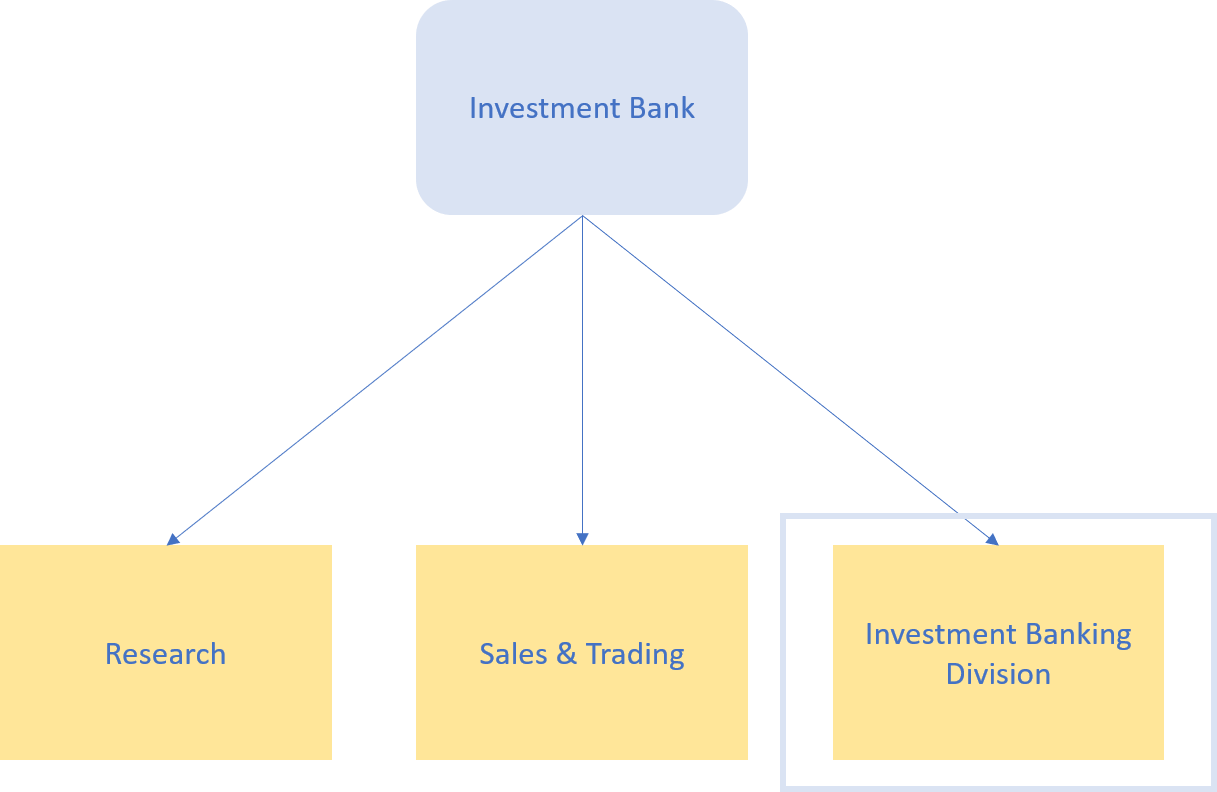

Investment Banking Division

The investment banking division at an investment bank, just like the sales and trading division, incorporates a wide variety of businesses and services. The organization of the division varies from bank to bank, but there are two common classifications of groups within the broader umbrella of investment banking: Industry Groups vs. Product Groups.

Industry Groups

When we hear industry groups, this usually refers to teams grouped by the industry or sector that they are covering. The deals that they are actually doing can range across the spectrum to traditional M&A advisory to equity and debt underwriting. Working in one of these groups, you would get to know an industry very well and be exposed to many types of deals. A few industry group classifications are:

- Healthcare

- Financial Institutions Group (FIG)

- Technology, Media, and Telecommunications (TMT)

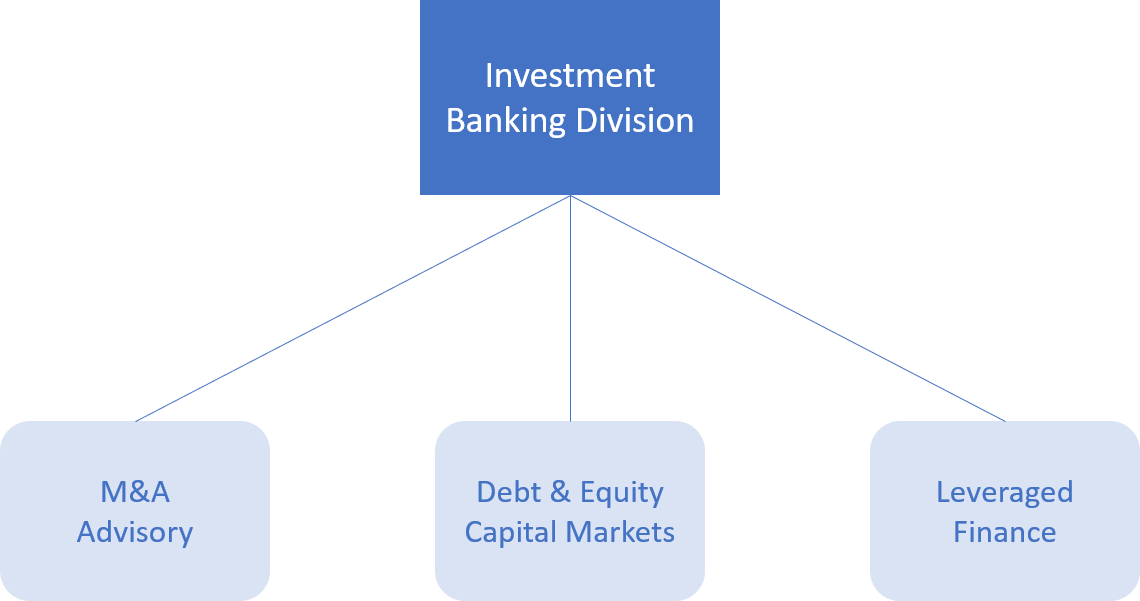

Product Groups

For the term product groups, this usually refers to teams grouped by the product or services that they are providing. The industries of the companies that they are working with can range from Industrials to Healthcare. However, you would get to know a specific product very well and know the ins and outs of how models work for the product/service. Throughout this website, we explain the structure of the investment banking division by product/service. The main product groups are:

- M&A Advisory

- Equity Capital Markets (ECM) (Underwriting)

- Debt Capital Markets (DCM) (Underwriting)

- Leveraged Finance (Lev-Fin)

Origination, Advisory, Coverage, Restructuring

- Origination refers to the process of creating the security for financing, usually referring to underwriting securities in ECM and DCM.

- Advisory refers to Mergers and Acquisitions advisory.

- Coverage is more or less the same as industry groups (the industries you cover).

- Restructuring is another form of financial reorganization for which corporations seek the advice of investment banks.

M&A Advisory

In M&A, the bread and butter of Wall Street, a bank’s source of revenues is the advice that they give corporations when one tries to buy another. The work being done in M&A advisory is all about valuation. When a company merges or acquires another company, it has to try to value the target of the acquisition to make sure it’s paying a fair price. The target also hires investment bankers to provide a valuation, and then the two sides come together and try to agree on a price. The junior bankers crank out models in excel using the company’s financial statements to try to estimate a company’s value, usually offering several versions depending on different assumptions used in the models. The mid-level bankers review these models, check them for accuracy, expand on them, and then hand them to the more senior bankers to present to their clients. As you can see, one starts out more technical, and with experience, becomes the relationship manager. Managing Directors are responsible, and compensated, for bringing in corporate clients which is the source of deal flow. No clients, no revenue!

Equity Capital Markets

IPOs and secondary equity offerings are the primary responsibility of ECM. Like the M&A team, the job is to try to value a company so it can offer its equity at a reasonable, attractive price to public investors. The models being done are a bit different because instead of having a two party transaction, it is just one company selling its shares. In any case, still expect to do plenty of excel modeling!

Debt Capital Markets

Public entities like state and local governments (municipalities) also need to issue debt just like companies. When a municipality issues bonds to finance itself, the teams in DCM do the underwriting and distributing to investors on the day of sale. Bankers in DCM help municipalities decided the proper interest rates to issue the bonds at as well as attracting investors. The junior bankers do much of the lower level analysis while the senior bankers verify those models and take care of the higher level interactions.

The private sector - most corporations and small companies - also rely on bond issuances to raise money. When a corporation issues bonds, it can be for a variety of reasons from refinancing existing bonds to investing in research and expansion. Bankers help corporations price their bonds reasonably and aid with attracting investors in those bonds. Responsibilities by seniority as above.

Leveraged Finance

For the teams in leveraged finance, their primary responsibility is to provide financing to companies and buyside firms like private equity and hedge funds that are trying to buy another entity. This financing through debt is the leveraged part of the deal because the buyer is not doing the whole transaction with its own money, but with borrowed money. The bankers try to value the buyout deal to see if it makes sense strategically, is financially sound, and how much of it the bank should finance. Bankers will need to be familiar with Leveraged Buyout (LBO) models and know how to assess the risk of lending to this type of borrower, so that they can charge an appropriate interest rate.

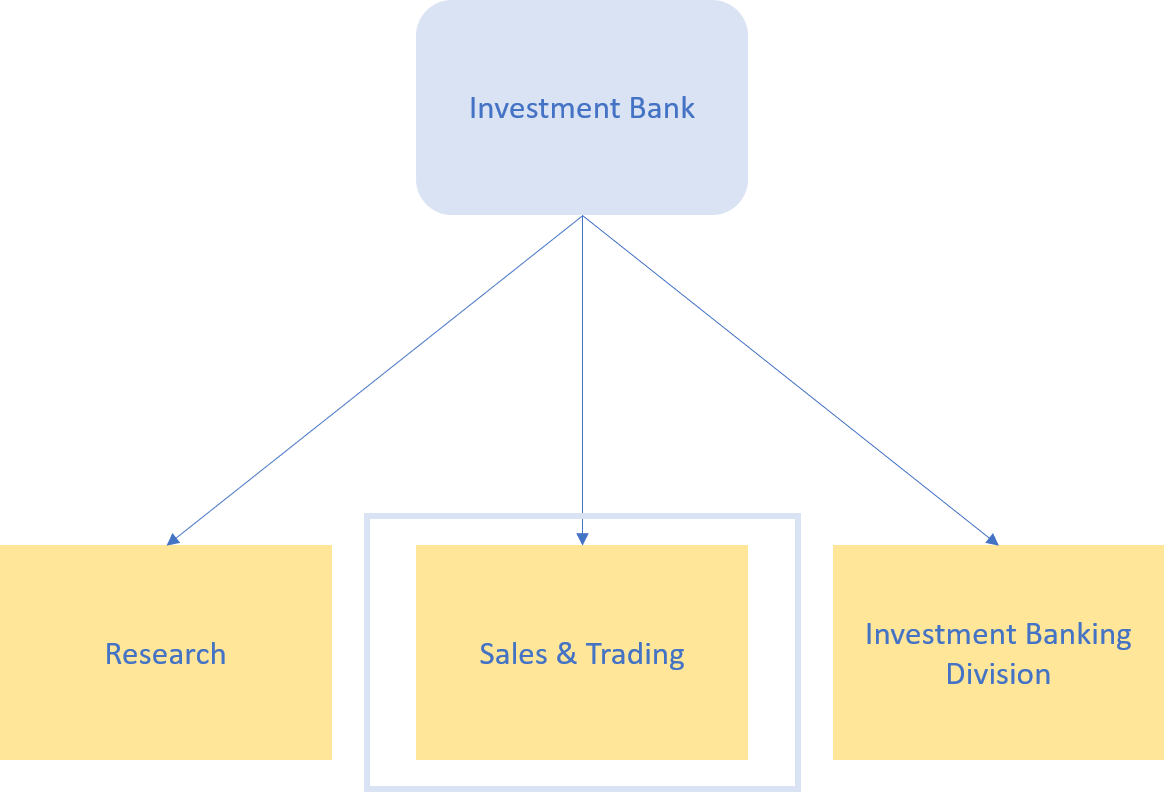

Sales and Trading Division

The Sales and Trading division of investment banks encompasses a wide variety of businesses which can sometimes be hard to classify - part of the reason for which some banks call it markets, using more general terminology. In this lesson, we will categorize sales and trading teams by their asset class. The physical organization banks is also often times by asset class - there are different floors for equities, credit, interest rates, foreign exchange, etc. Generally on trading floors, hierarchy is more flat than in the investment banking division. What we mean by this is that the responsibilities of a junior trader vs. senior trader are more or less the same, but senior traders have larger trading books and manage more money than the junior ones. Sales teams have a little more hierarchy because of their client-facing type of work. Generally across all asset classes, sales roles serve to find and maintain clients that need the bank’s trading services.

Equities

Equities trading refers to the trading of shares of companies on exchanges and over the counter, or OTC. These services are mostly to provide liquidity to large institutional investors on the buyside that wish to buy and sell shares of their investments. The responsibilities of a trader can be fulfilled either as an agent or principal - a discussion that is available for reference in the lesson Banks under Finance Fundamentals.

Cash trading refers to vanilla stocks or ETFs that are very liquid securities typically with low spreads. Back in the day this was very profitable, but with the rise of electronic trading, the bid-ask spread in most stocks have narrowed to the point that it is hard for traders to make a profit.

Derivatives trading refers to security instruments that derive their value from an underlying asset. In this case, the value of equity derivatives change with the value of their underlying stocks (or ETFs). Derivatives include options, futures, forwards, swaps. We will not get into the technicals of what all of these are for now, but just know that they are usually used for hedging (protection) or speculation. Corporations usually use them for hedging out their exposure to certain commodities - for example, a car company hedging out their exposure to the price of certain metals in case costs increase. Hedge funds use them for both protection and speculation - making bets on certain securities.

Credit

Credit trading refers to the trading of debt of companies as. This may be separated from the trading of debt of government securities due to the different types of risks they are associated with and the level of risk overall. Generally credit (corporate bonds) is more risky than federal government bonds. Government bonds are also a little more related to macro-economic factors like short term and long term interest rates, which is why we will discuss government bonds under the Fixed Income label. Traders in credit provide liquidity to investors that buy and sell bonds of corporations and profit from fees and bid-ask spreads. The spreads in credit have narrowed to a lesser extent than the spreads in equities, meaning traders have an easier time generating profit in credit, all else equal. This is probably because of the larger dollar nominal sizes of bonds compared to equities, which means there are fewer buyers and sellers, less liquidity, and wider spreads.

Cash refers to the trading of the bonds themselves while derivatives refer to instruments that derive their value from the price of bonds. These also include options, forwards, futures, swaps, etc. One noteworthy derivative is the credit default swap, an instrument used as protection against the default of an underlying bond. These instruments were central to the bankruptcy and riches of many people during the financial crisis, which we will not go into detail for now.

Asset Backed Securities

Securitization is the process of transforming otherwise illiquid assets into a security that is tradeable and investable. Asset backed securities are financial instruments that are backed by a variety of assets such as credit card receivables, mortgages, auto loans, etc. All of these are products that provide an income stream for the owner of the contract, and after being securitized, can be sold to an investor. If it can be sold in public markets, that means there are traders and sales people at investment banks who deal with these products.

Macro Products

FX

Foreign Exchange trading, or FX, is the trading of currencies. Any company or government that does business internationally needs this service because of their global reach. The FX asset class is the most macro because it is mostly dealing with economics between countries rather than within countries. It is also the most liquid of any asset class because everyone uses currency and thousands of transactions happen every second. Traders provide liquidity to institutions that need to exchange or hedge large amounts of currencies. Since the spread is so low, there are fewer FX traders that profit the same way as they did decades ago. To take on more risk than traditional market making, one might have a view on where currency trends are heading in the near or medium term.

Interest Rates

Interest rates trading deal with fluctuations in different types of interest rates contracts. It might not be obvious exactly how you would trade an “interest rate” when it is just a concept rather than an actual asset. However in practice, it just refers to trading the interest rate contracts two parties make when a payer and a receiver agree on a rate. This might be in the form of swaps, futures, or forward contracts. Corporations that have a lot debt outstanding might want to protect themselves on interest rate moves that might affect their debt payments.

Fixed Income

Fixed income in the broader world of finance and investing usually refers to all instruments that make fixed payment amounts over a period of time. Inside an investment bank, this might instead refer specifically to highly liquid federal government bonds instead, like treasuries of various maturities. Because the treasury market is so large - the U.S. Government has over $20 trillion of debt outstanding - a whole set of teams is devoted to trading these securities.

Commodities

Trading occurs in commodities such as oil, gold, aluminum, wheat, corn, etc. While the physical assets are not actually being traded, usually it is the contracts (for delivery of these commodities at a certain price) that are traded.

Derivatives

Derivatives of macro products like FX and commodities are used by companies to hedge out their exposure to these products. For example, a U.S. car company that sells both in the United States and Europe will encounter fluctuations in its income due to changes in exchange rates. A car sale generating $10,000 in the U.S. will always be $10,000. However, a sale of 9000 euros in Europe that converts to $10,000 today might only convert to $9500 six months from now due to moves in currency markets. That’s a 5% loss in revenue, something the car company would want to protect against.

Other Products

The above categories cover much of what is being traded at an investment bank, but in an industry so large, one cannot possibly cover every product out there. Other financial instruments include warrants, convertibles, structured products (combinations of bonds and derivatives), etc. Other related services offered by an investment bank that may interact with traders include FX payments and transactions.

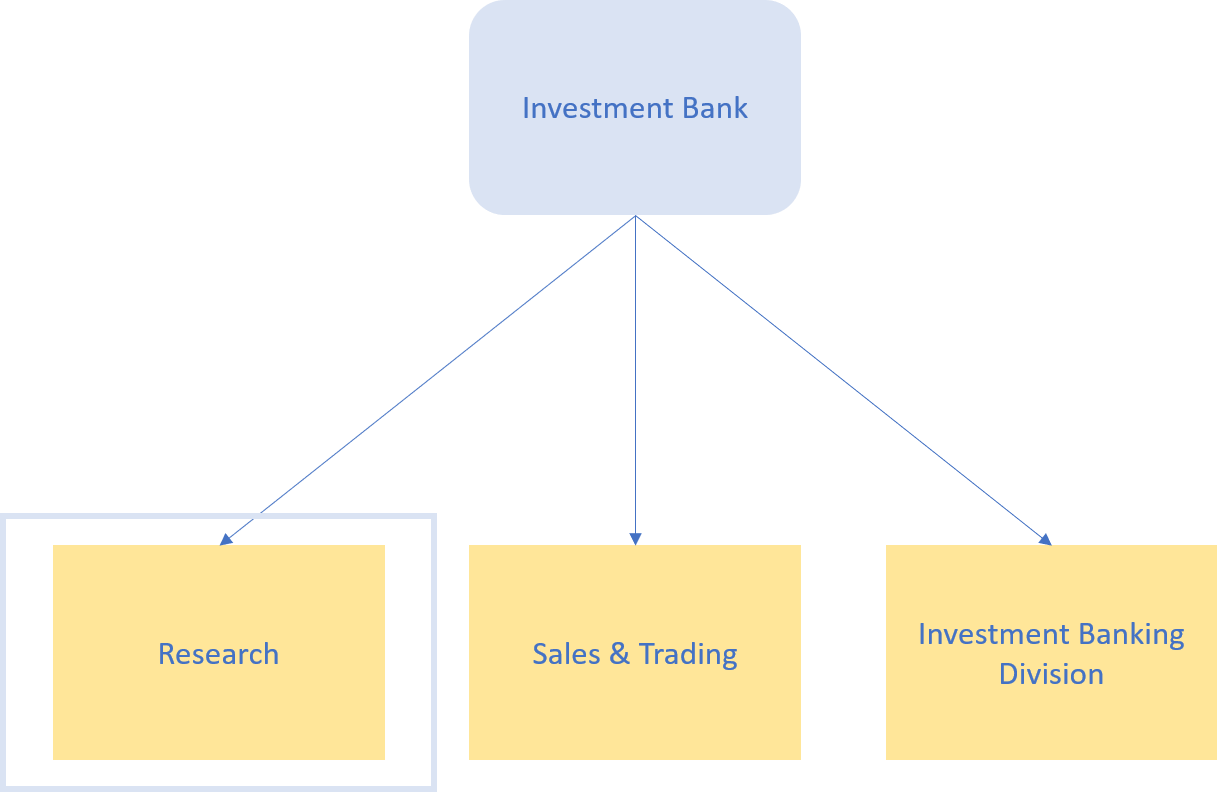

Research

Research at investment banks provide information services to the public in the form of research reports. This can cover any asset class, but the most widely broadcasted reports are the equity research reports on stocks of companies. Here, research analysts have a list of companies that they follow, usually divided up by sector or industry. They attend conferences in their respective fields to keep up to date with industry developments and get to speak face to face with company management. They keep running versions of valuation models on the companies that they follow, and update them when important events happen, such as earnings releases. While their research reports are available to the public, many buyside institutions also give them calls or speak to them in person to get more color on certain companies, industries, and deals going on. Below is a photo of the consumer electronics show, an annual conference widely attended by people interested in the tech and consumer products industries.

Review

Navigating the ins and outs of an investment bank’s structure is a challenging task. Having a substantial idea of what kind of opportunities are out there is important step in identifying possible career opportunities. While we should not jump to conclusions on what exactly we will want to do for a job later on, knowing what goes on inside those shiny glass buildings brings us closer to making an educated decision about employment opportunities at an investment bank.