You

To prepare for recruiting and interviews, it is important to think about things from both your own perspective and the firm’s perspective. You are trying to find an attractive, rewarding job that suits your skills, personality, and interests. The firm is trying find an employee that is competent, can get along with people, and has the relevant skills, and is interested. By thinking from these two perspectives, it will be easier to go through the recruiting process without feeling like you’re grabbing for something in the dark. If you are unsure about a job, think about your own values. If you are unsure about what a potential employer thinks, try to ask yourself what are they looking for, and maybe imagine yourself in the employer’s shoes.

Note that these days, it is more often for investment banks to hire junior employees from its intern class rather than full time. Because of this, internships are rather important. Other types of financial institutions are less rigid about recruiting and applying online through their website, linkedin, or other job pages can be effective. The buyside is much less structured and uniform in recruiting, and hires when they need to. Below is a hardworking and enthusiastic worker bee to inspire you.

Background

While no one factor is the make or break in the hiring process, an employer typically starts by looking at your background. In the financial industry, it would make sense to hire economics, accounting, and finance majors, but it would probably be a boring workforce if that was the entire composition. The financial industry is definitely open minded about hiring people with degrees outside of what is typical. Often times, skills are more pertinent than degree. It also depends on the role that you are applying for. For example, an investment banking interview will definitely ask about the 3 financial statements and accounting questions.However, this doesn’t mean you have to be an accounting major - all you need to know is the relevant knowledge. For sales, it is even more flexible. It is more important to be sociable, reliable, and look presentable than to have a specific technical skill set. Most people can learn the information, but it is the character traits that are important for sales. For traders, generally you need to be somewhat competent in math and can think on your feet. However, this also depends on the type of assets you are trading. It’s possible to go on with examples, but as you can see, certain backgrounds make your life easier in recruiting, but are definitely not determining factors in the hiring decision process.

Knowledge and Skills

Certain skills are desired but most work relevant skills are learned on the job or in training. Most financial firms do not expect a new hire to come in knowing the ins and outs of trading systems and how the workplace is run. Even desired skills like excel-fluency cannot be verified during the interviews and it is unlikely to be asked about a specific excel function unless the the topic comes up (do not boast about something you are not familiar with). Certain types of knowledge are very useful - accounting in investment banking, economic and market knowledge in trading and investing. If you are interviewing for a buyside firm or a trading position, it is highly likely to be asked questions on market trends and a favorite stock. Medium difficulty math questions or brain teasers may come up for trading roles, but nothing out of the world unless you present yourself to be technically advanced - like a math major.

Experience

Experience in any hiring process is ideal, but banks do not expect extensive experience. They do expect that you have done relevant work in the past. For example, an investment banking interview might not expect past internships - everyone has to start somewhere - but might ask whether you have been in your school’s investment club, or done some stock valuation in other settings. The buyside is a bit less lenient about experience in the sense that they do expect you to be knowledgeable about the investing world and have some degree of prior exposure. Because of this, there are fewer entry level positions on the buyside than on the sellside. However, don’t be discouraged - they definitely exist!

Personality

Knowing your personality and working style is important for deciding which types of roles are more suitable. If you enjoy slower paced and project based working environments, research and investment banking might be suitable for you. If you enjoy the dynamic come and go of trading floors, then sales and trading might be a match. There are also of course roles that are between the two extremes.

Interest

Passion for your work is probably near the top of the list for both employees and employers. On one hand, you need to be truly interested in your work do a good job at it and to go above and beyond. On the other hand, your employer wants you to be actually interested in the work that your doing so their employees are satisfied and productive. This match will take some time to find, but you should not lie to yourself about whether you actually enjoy your job, or just the prestige and perks that come with it.

The Firm

What Does the Firm Do?

The other side of the consideration is about the firm. What exactly does the firm do? You should be knowledgeable about it for your own sake since it is useful to know how different branches of a company interact, but also useful because your interviewer might ask you!

Firm Culture Fit

Know the culture of the firm, or at least what it is known for. What is the reputation of the people working at and coming out of the firm? It might be hard to generalize about so many people, but at least know what the firm is good at doing. Also, it would be a good idea to know your preferences, as in working in a small entrepreneurial setting, at a medium sized company, or at a big corporation.

What Does the Team Do?

If you know what type of role you are applying for, what does the team(s) in that division do? One way to find out about the people on the team is to establish some contacts and set up phone calls to talk to the people on that team. This can be through school alumni, family friends, who can always refer you to someone else they know who may work in at that firm, or in a similar role at another firm.

Team Culture Fit

Once you have made some calls and talked to people on the team, it is nevertheless important to try to meet someone in person because you can never substitute face to face interaction. If you happen to be passing by the city or on a break, you should take the opportunity to visit the firm at which you’ll be working at. The employees will be happy to show you around if you set something up with them by email. Phone calls are informative, but if you want the team to remember you, they have to put a face to the voice. It will also be a great chance for you to get a feel for the people there before interviews come around. It is generally good to be confident, knowledgeable, and inquisitive, but not over the top that the employees can obviously tell that you’re putting on a show. They’re probably not going to want to work with a showoff. It’s up to your judgement of what is confidence and what is arrogance.

What is the Firm Looking For?

Lastly, be aware of what type of employee the firm is looking for. It’s good to know what types of skills are desired, if there’s a shortage of a certain type of skill on the team or at the firm. There might not be an obvious specific need, but the job description and online forums should give you a reliable idea of the desired skills.

Resumes

The resume is the first step in the recruiting process. It will get your foot in the door, but don’t be mistaken, not all resumes are created equal and not all resumes are treated equally.

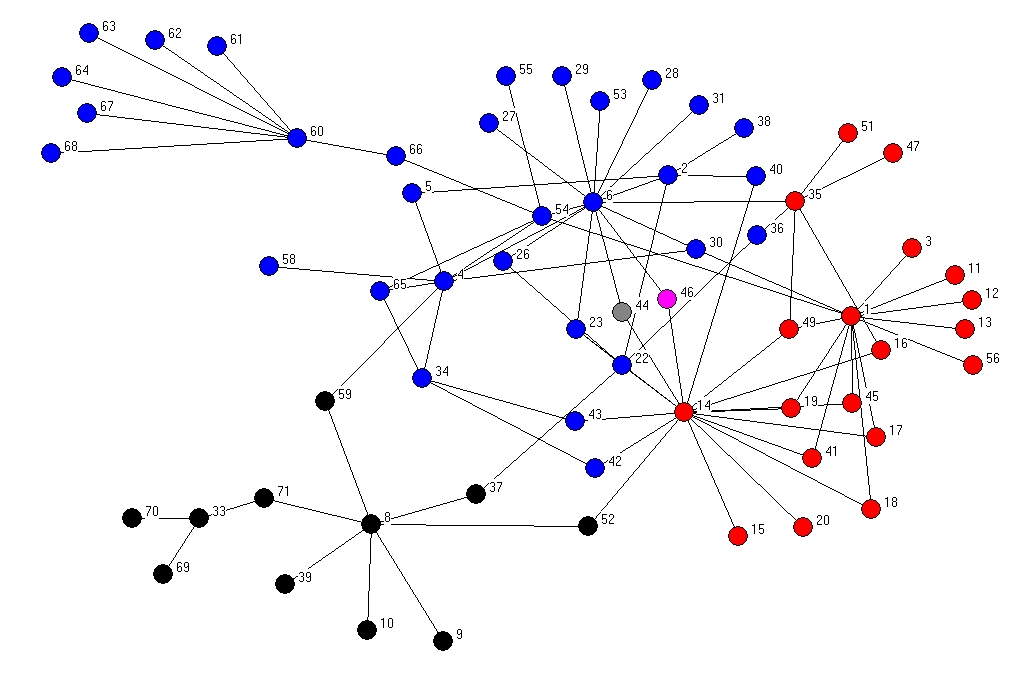

Imagine a recruiter sifting through 200 resumes and needs to pick 40 to interview. He/she has hosted many info sessions and events, talked to fellow employees, and is tired of looking through pages of black and white text. So what happens? Most likely, fellow employees will give their feedback first on who they’ve met, and certain names will be flagged. An applicant who has met someone at the firm is more likely to accept an offer and be serious about applying rather than a random online applicant who is just filled out a form on a whim. Those names mentioned by fellow employees will probably be looked at first to see who is eligible. Then comes the remaining pool of remaining resumes for the remaining slots. Of those, the most qualified will be chosen, and interviews will be set up. Note that this is just a gist of what might go on to show you the importance of establishing contacts and thinking from the firm’s perspective, not exactly what actually happens.

Resume Content Guideline - note that this is a list of important information to include, not a specific format to copy.

- Name, contact info - this is basic information

- Education - shows your background, include graduation date

- Work Experience/Relevant Finance Experience - shows what experience you have had so far, with particular emphasis on relevant experience

- Clubs, Organizations - shows leadership, passion, initiative, character

- Skills, Interests, Hobbies - shows relevant job experience, and interests/hobbies so people know that they can talk to you about something outside of work. Very few people want to talk about work all day long and nothing else like sports, music, art, travel, etc.

Networking

Whether you are in school or out of school, info sessions and firm events are the best way to establish contacts. If you are in college, campus recruiting events are a solid way to meet people - if they’re not too crowded. Either way, these events allow you to meet a few employees, get to know the HR recruiters, and provide an avenue for you to access more information about the firm.

Once you meet some people who work at the firm who seem willing to help out, don’t be shy to set up a 1 on 1 call or even an in office visit afterwards if you happen to be passing by the office of the firm to which you are applying. It’s important to maintain these connections because behind the vague recruiting process, there’s no telling how much help they will be. It is even possible that if you get along really well with an alumni, they will help you throughout the recruiting process from resumes to final round of interviews and even tell you that they will push for you.

Interviews

Throughout the rounds of interviews, you will encounter a variety of types of questions. However, these can be roughly divided into 2 types: behavioral and technical.

Behavioral

When we use the term behavioral, we mean the types of questions that are about personality, character. This will include questions like why firm X? Why trading/ibanking/sales/wealth management? Why finance? They want to know that you are interested in them and not just any firm. They want to know that you know what you are getting yourself into, and have done the research before deciding which position to apply to. This can be a good time to mention how exactly you came to your decision - what you know about the job, how it suits you, people you met, etc. Other question types can be about how you handle tough situations, work on a team, etc.

Technical

When we use the term technical, we mean the types of questions that are about your knowledge and way of thinking. This will include brainteasers, math questions, market awareness, economic knowledge, stock pitches, accounting knowledge...etc depending on the type of position you are interview for. For example, for a trading role is more likely to get a math question that demands you to think on your feet while an investment banking role will probably get an accounting question. It would be a good idea to practice with friends - have them read from a list of popular question found online, and see how well you handle the pressure.

Rounds

The interview process is usually broken down into a first round, second round, and/or a final round depending on the firm. Most firms will have 2 or 3 rounds. The first one is usually a get to know you and brief test of basic economics/finance/market knowledge and will probably be rather generic. The second round will probably more relevant to the role you are applying for, longer, tougher, and with several interviewers. Interviews will usually be in person face to face, unless you are physically unable to accommodate that, as with study abroad students who will need to do virtual interviews. There has also been a rising trend of virtual interviews for the first round. This will vary depending on the firm.

As time goes by, the specific mechanisms of interviewing will change with it. However the basic things employers will be looking for will be the same. As described earlier this lesson, they will be considering: Is this person competent? Is this person a fit for this team/firm? Does this person seem actually interested in and willing to follow through?

The Offer

Finally, as we discuss the offer, keep in mind that the world is filled with opportunity. Just because an offer is prestigious doesn’t mean it is right for you. If you end up getting an internship or job offer, you might not even end up liking it that much. It might be good on paper, but in the long run, it is more important to find the job that you are passionate about and actually enjoy.

If you get the offer, you can accept right away, or decide to wait. At this point, there are advantages to waiting if there is another firm you prefer. In any case, there is no rush. If you are worried about your offer expiring, you can always ask HR to give you an explicit date by which you have to respond. Employees that you have been involved with during the recruiting process will start to contact you to persuade you to accept the offer! Once you decide on an offer to accept, congratulations! With that first internship or job, you have now officially stepped into the world of finance!

Review

This lesson contained many tips and guidelines to help you through the recruiting process, but don’t just take our word for it, do your own research as well! Nothing better than talking to people in the industry to get to know it better and also to establish your network for the future. Best of luck!