Introduction

The sellside of finance is what most people call “Wall Street” - the big banks that make headlines in mainstream media. However, it might be easy to forget that this is technically only half of finance - the investors themselves don’t get as much press coverage. It is probably reasonable to guess that more people have heard of the biggest bank in the US - J.P. Morgan Chase - than the biggest asset manager in the US - Blackrock. While both sides of finance are important to each other, we will begin by discussing the sellside and the services that it provides. It is possible to explain the sellside in many ways, but for this lesson, we will categorize its services by client type.

For Corporations

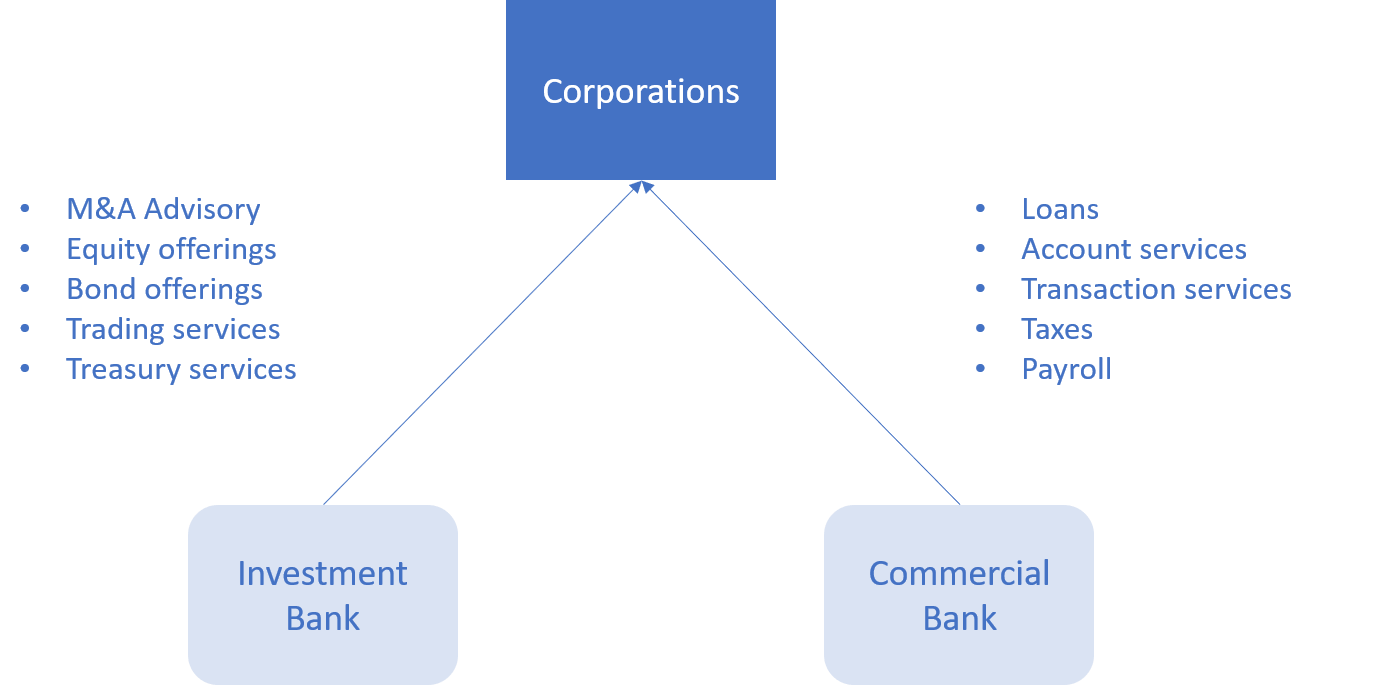

The two types of banks that deal heavily with corporations are commercial banks (different banks actually label their divisions differently, so for simplicity, we will refer to a commercial bank as a bank servicing businesses of all clients, large and small) and investment banks.

A commercial banks’ major clients are the corporations that they lend to. They provide a variety of banking services to these clients, and this means that they require a diverse workforce with different skill sets. These services include providing loans, bank accounts to process transactions for a company’s working capital, accounts for a company’s investments, corporate credit cards, payroll, taxes, etc.

An investment bank’s major clients also include corporations. They provide investment, trading, and financing services to these clients, which also requires a wide range of skill sets and demanding hours on its employees. These services include M&A advisory when corporations desire to complete acquisitions, leveraged finance when for raising capital to fund acquisitions, Equity and Debt capital markets for financing through issuing stocks and bonds, trading for hedging exposure to raw material prices, research analyst coverage to attract investors, etc.

For Institutional Investors

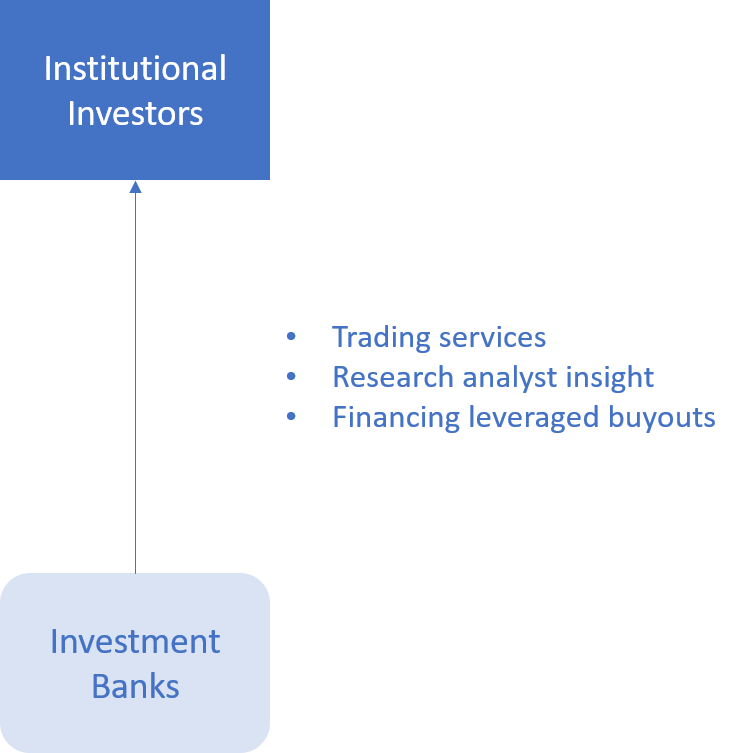

To the institutional investor, the trading services offered at independent broker-dealers and the Sales & Trading divisions of banks are vital to daily operations. Sellside traders provide the liquidity that institutions need so that they get accurate, reliable prices while avoiding making any moves to drastically impact the market (usually, it is ideal to execute a strategy without impacting the market in a way that gives away what that strategy is). Traders also offer more specialized products and services such as currency hedging, options and futures trades, and custom-made derivative products. Research analysts give context and perspective on companies and sectors an investor might not be familiar with.

For Individual Investors

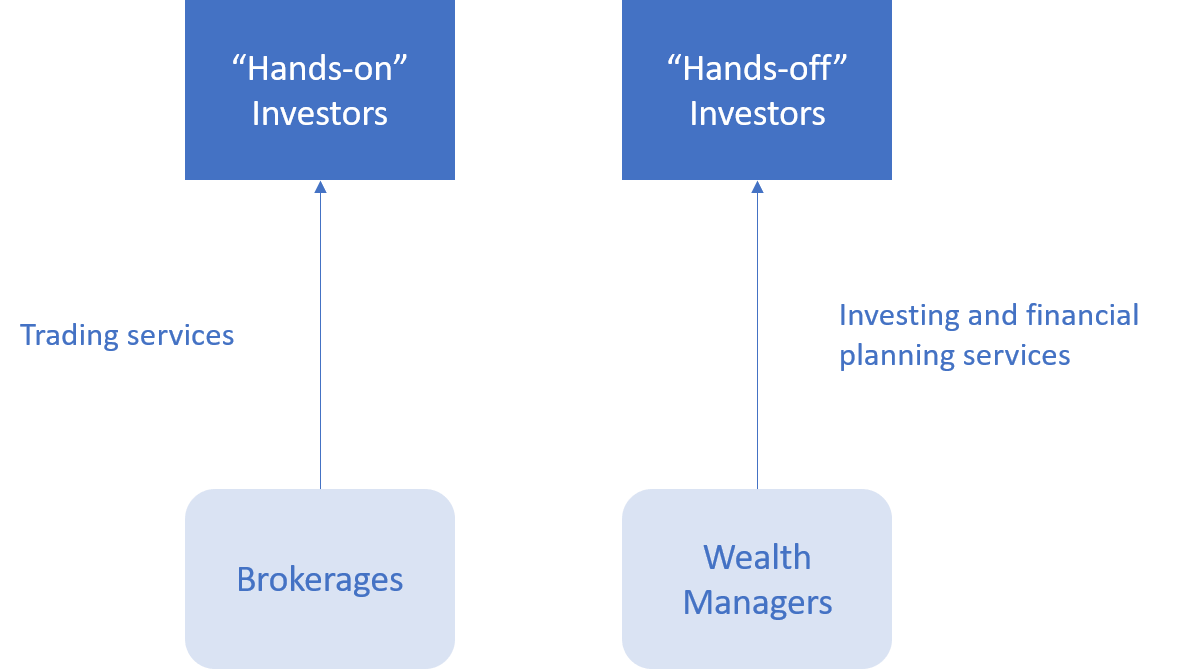

The individual investor has a variety of options to choose from as ways to invest. The sell side offers services that can satisfy both the hands on, active investor as well as the live and let be passive investor. Different people have different preferences when it comes to how involved they want to be with their finances.

For the more hands on investor, there are brokerage institutions like Charles Schwab, TD Ameritrade, and Fidelity Investments that offer trading accounts for individuals wishing to do their own trading and investment decisions. These companies also provide sit-down financial planning services.

For the more hands off investor, there are wealth management divisions at banks as well as independent financial advisors that provide financial planning for individuals who want a professional to take care of investing. Of course, this is a higher degree of responsibility, and there are strict regulations imposed by the SEC and FINRA that dictate what types of practices are ethically sound and legal.

For Consumers

Our day to day lives rely on the transactional services that retail banking offers us. From checking accounts to credit card services, banks occupy the whole spectrum of products that we could possibly need. Generally they treat their depositing customers really well because not only would they get more deposits from their clients, but those same loyal clients may also use some of their other products like mortgages and credit cards. Across different types of banks, there’s demand for all types of employees. If we think about finance, some might imagine it as an industry for people great with numbers. But it is important to remember that business doesn’t get done by just numbers - your clients have to like you to do business with you, whether that’s at the retail, corporate, or institutional level!

Review

Finance can be an intimidating industry to start out, and an overwhelming on as far as a job search goes. So many positions available, so many we haven’t even heard of! Of course while the following lessons will not be able to cover every sort of job out there, this lesson gave us a basic framework from which to think about the industry - what are the types of services provided?