What to Invest In?

One of an investor’s first questions when building a portfolio should be what do I want to invest in?. This can depend on two factors:

Risk Appetite

Investors are a diverse group, so accordingly, their investment strategies and portfolio allocations are different. Some factors that might influence an investor’s risk appetite may include age, personality, knowledge of investing, and personal financial situation. Generally, equities are the riskiest asset class since it offers the potential for greatest returns. Fixed Income and Real Estate are relatively safe but offer lower returns. Cash is the safest, but offers lowest returns. Commodities are not investments that generate returns - something like gold does not generate interest, dividends, or rent payments. Commodities are mostly used to protect against inflation, or for those who want to speculate on their prices, which is not really investing.

Liquidity Preference

Investors also have different liquidity preferences. This refers to the ability to get out of an investment and turn it into cash at a reliable price. For example, stocks of large companies traded on exchanges are very liquid, meaning for a $100 stock, we can probably sell it for within a few cents of its listed price by the time we execute our trade. Bonds are more difficult for the average investor to trade because in bond markets, transaction sizes are generally too large for an average investor to afford. Commodities are physical assets, so they must be traded in futures or ETFs, which are reasonably liquid, but there can be other costs that eat into our returns, like storage costs that the USO ETF incurs. If we compare the chart of the price of WTI Crude Oil and the USO ETF, we notice that USO underperforms WTI over time. Real Estate is the most illiquid. Imagine the process of buying and selling houses - it takes weeks, even months to buy or sell, and we can never be completely sure on the exact price we will end up getting. Cash on the other hand, is the most liquid. We can exchange a dollar with anyone on the street as well as deposit and withdraw from a bank.

Tax

Investors should also consider the tax impact of their investments. If we pick a great investment and end up paying more tax than we need to, our effort gets canceled out. We will not discuss in detail tax implications, but just keep tax planning in mind when making big investment decisions or talking to your financial advisor.

Equity

Public equities are stocks that trade on exchanges. These represent pieces of companies, and when we buy stocks, or shares of companies, we own a part of that company. Because owning a company is essentially betting on its success, we are taking on greater risk in the hopes of greater return on our investment.

Private equity refers to ownership in companies that do not trade publicly. These investments are illiquid and should therefore be considered with a longer time frame in mind and with an awareness of its constraints. On the upside, we can then focus on the company itself and forget about a share price that swings around every day.

Fixed Income

Fixed Income is an asset class that includes a variety of products that provide us with an income stream that is fixed in amounts over a period of time. This encompasses a variety of products, which will be described below.

Bonds are debt securities that are issued by companies or governments. They pay out interest periodically to compensate lenders for lending out their money. Although they can be issued by public companies, transactions occur over the counter or OTC where parties trade with each other directly instead of through an exchange. This is part of the reason why individual investors, to get exposure to bonds, often use ETFs or invest in a bond fund instead of the individual bonds themselves, or need to resort to buying from a broker.

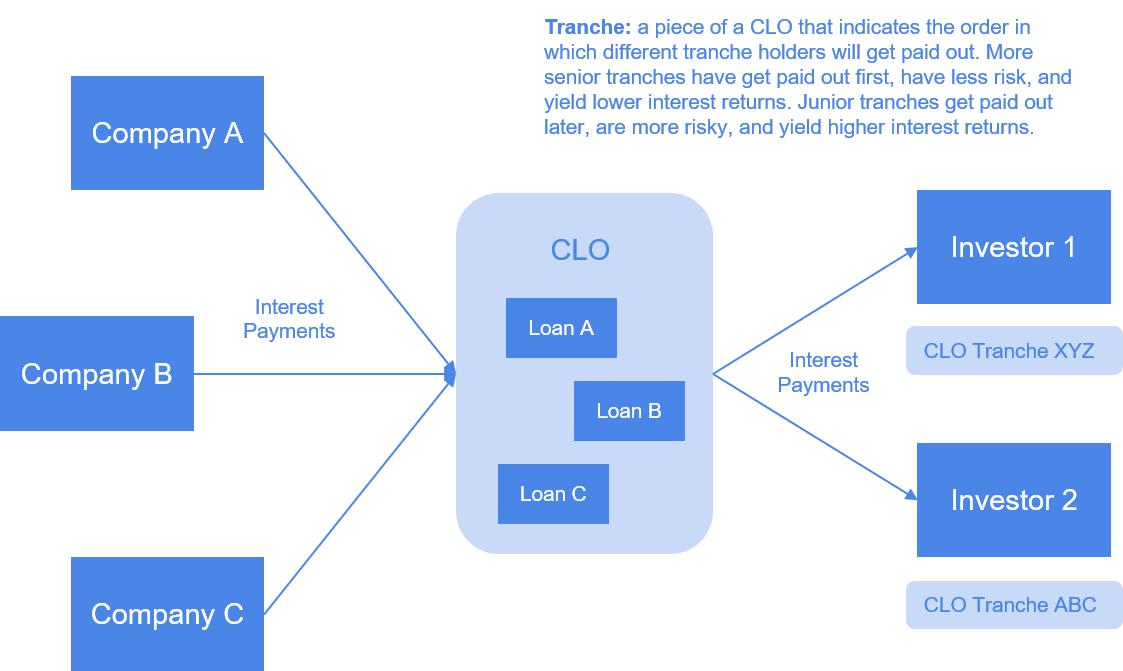

Loans are basically contracts between a borrower and a lender dictating terms, conditions, and scheduled payments when a lender lends to a borrower. They are not typically publicly traded, but can be packaged into products that are more easily accessible to investors like collateralized loan obligations, or CLO. These packaged products are more catered to institutional investors than individual investors, but are nevertheless available through ETFs or certain funds.

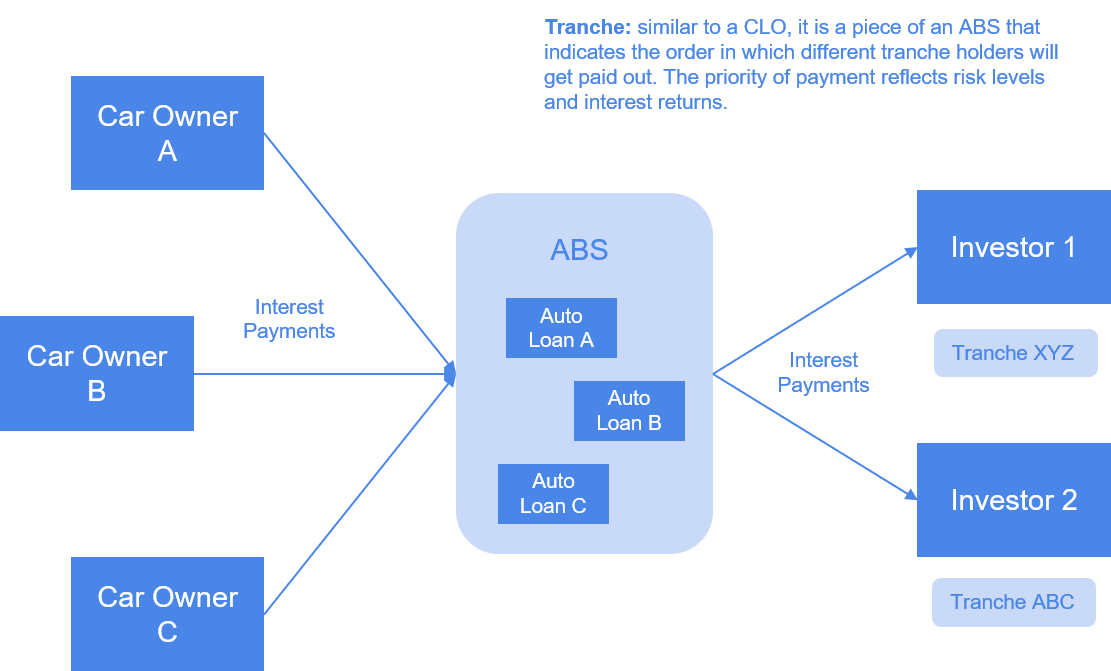

ABS are securities that are backed by various types of assets like car loans, credit card debt, etc. Payments to the holders of these types of securities are made in fixed amounts at given time frames, often monthly. These packaged products are more easily available to institutional investors than individual investors, but nevertheless available through ETFs or certain funds.

Commodities

Gold

Gold has historically been a valuable asset for empires, kingdoms, cities, families, and individuals. The shiny metal is used in jewelry, decorations, monuments, teeth, or just stored as bars. It has played an important role in the evolution of money, and continues to be valued as a safe haven asset today. While we can own pieces of gold at home, it is inefficient to buy and sell the physical product. For this reason, there are futures and ETFs that track the price of gold. A widely traded ETF is GLD. We will go over types of products - ETFs, futures, derivatives - in more detail in the lesson Investment Products.

Oil

Oil when first extracted from the ground and before refinement is called crude oil. This material is a mixture of the different types of hydrocarbons that we use for daily tasks. Crude oil can be refined into various products like gasoline, propane, jet fuel, diesel, etc. There are benchmarks to track some of these products, but by far, the most commonly tracked commodity is crude oil itself. One widely traced measure is West Texas Intermediate crude, or WTI. This is crude oil distributed from Cushing, Oklahoma, a trading hub that covers much of the midwest and gulf region of the United States. Futures on the price of this oil are traded, and a widely traded ETF is USO.

Other commodities include metals, agricultural products, lumber, etc. Most individual investors do not seek or do not have a way to “own” these commodities.

Real Estate

A comparatively illiquid but potentially very attractive type of investment is real estate. These types investments have the advantage of being backed by physical property. Of course like other asset classes, we can gain exposure to real estate through mutual funds and ETFs. Here, we will go over types of real estate: residential and commercial. We will also discuss the real estate investment trust or REIT.

Residential vs. Commercial

Residential real estate, as its name suggests, refers to the housing where individuals and families reside. Single homes for the consumer is the relevant market. When commercial real estate is mentioned, it refers to buildings for business use. When a company needs to find office space or build a factor for its operations, hotels, malls, etc, there needs to be real estate available to support that. During the financial crisis, the belief was just buy real estate because throughout recent history, there hasn’t been a sustained national decline in housing prices. The declines were mostly regional. But the crisis showed that it can happen if speculators overvalued homes and drove prices to unreasonable levels. While not many people can buy and sell physical homes as investments, it is certainly possible for those with the money. Otherwise, there are plenty of investment vehicles that offer real estate exposure.

REIT

The real estate investment trust is one of these vehicles that offer investors exposure to real estate. It operates in a similar manner to many other funds, in the sense that investors buy shares that represent ownership of the investment trust. With that pooled money, the investment trust buys real estate, leases it out for various uses, and collects rent as income. That income is then distributed as dividends back to shareholders. REITs often have a focus on a type of real estate, whether its healthcare, office space, retail, or it can be diversified.

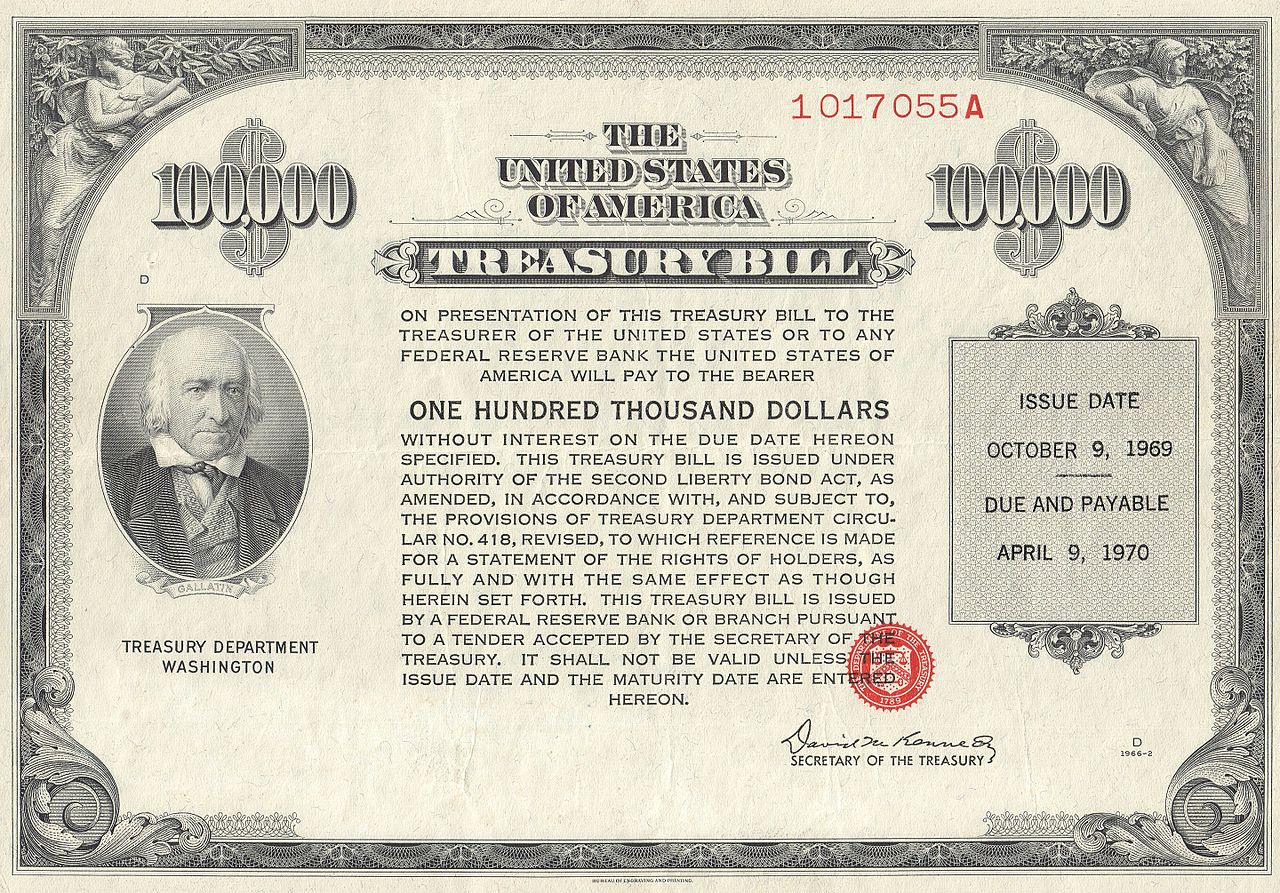

Cash

The money market refers to a market of highly liquid short term securities. These can be useful as a place to park cash to earn a small return over a short time frame instead of leaving it in a bank account that earns nothing. They are essentially cash-equivalent because of the ease of getting in and out of these investments. In any portfolio, there will be times when not all the funds will be fully invested into its main asset classes like equity or corporate bonds. To still earn a return but avoid risk and volatility, these types of investments are ideal. In the investment world, money market securities can be described as cash or cash equivalents because of their liquidity and safety.

Review

What to invest in is an important decision to make. Knowing our risk appetite and our liquidity needs helps us determine what types of investments are suitable. Over the course of our lifetimes, our asset allocations will vary, not only because of our age but also because of our financial situations and the broader economic cycle. In the next lesson, we will discuss different investment vehicles - the platforms through which we invest.