Smoothie Stand

To understand investing, the finance industry, or frankly, most of the economy, it is important to know how companies are structured, how they grow, and the motivations of the people involved. To illustrate this, we think it will be best to use an example. Throughout this lesson, we will use a friendly neighborhood smoothie stand as a template for explaining exactly what is a business.

Launch

Let’s imagine that Sally runs cross country in middle school. One warm spring day after her jog on a popular neighborhood greenway, she really wanted a smoothie but couldn’t easily get one. She thought, wouldn’t it be convenient for joggers, bikers, and strollers to be able to get fresh smoothies after they exercise? Sally decides to start her smoothie stand next weekend when there are plenty of people exercising on the greenway. What are her start up costs?

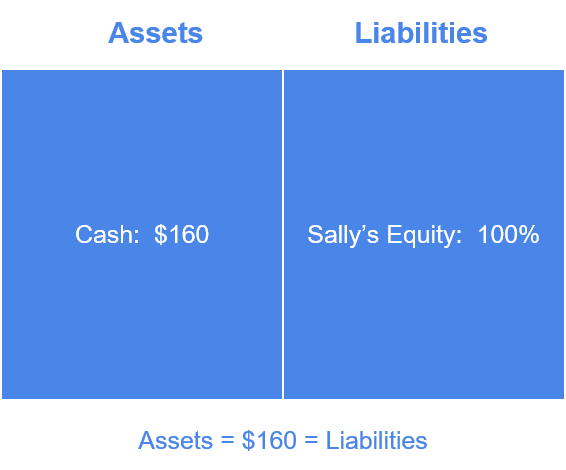

Let’s pretend that Sally had $160 of cash in hand before starting the business. She started this company, Sally’s Smoothies, so she owns 100% of the equity. There is no debt because she hasn’t borrowed from anyone. At this point, we should talk about assets vs. liabilities. Balance sheets describe the financial situation of the company or entity, categorized in assets and liabilities:

- Assets - things that are of value or may bring future value. Examples are cash, inventory, land, equipment, buildings, investments, etc.

- Liabilities - a company’s obligations, things to be owed to someone in the future. Examples include debt, equity, credit card balances, notes payable (anything ending in payable refers to something already received but has to be paid for in the future, thus an obligation).

- Total assets must equal total liabilities.

For Sally’s Smoothies, its assets are the $160 in cash that Sally has devoted to her company. Its liabilities are entirely equity that Sally owns - that is, the company has obligations to the holders of its equity, its owners, which in this case is one person, Sally. If she had partnered with her friends, there might be two or more owners dividing up the equity (ownership) of Sally’s Smoothies. Equity is divided up into shares or stock. Since it is a private company, the shares are not traded. The number of shares is arbitrary - it can be anything since the percentage is what matters, but often times to start out, easily divisible numbers are used. If Sally had partnered with two friends in and given each friend 20%, then if Sally’s Smoothies had 100 shares of equity, then Sally would get 60 shares, 20 shares for friend A, 20 shares for friend B. But for now, let’s just stick to Sally owning the whole company. This is what the balance sheet of Sally’s Smoothies looks like to start out:

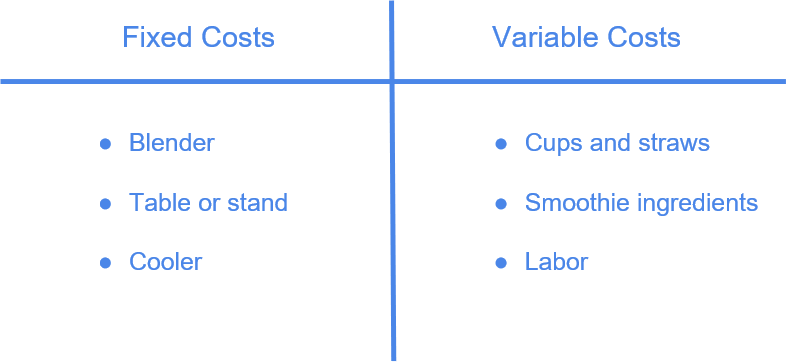

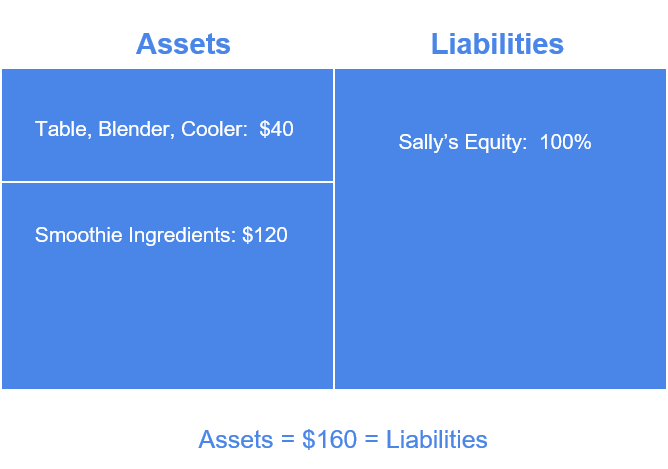

Now Sally has to start to set up her operations so that when the weekend comes, she will be ready to serve customers. She buys her equipment from her mom at a discount price, and produce from the supermarket. In any business, there are fixed costs and variable costs. In this case, fixed costs are equipment, which might be a battery-powered blender, a table/stand, and a cooler - these are fixed because they are more or less one-time purchases. Her variable costs are the ingredients to make the smoothie like milk and fruit, cups, straws, napkins. She thinks that if she buys her ingredients in bulk, then she can definitely make a profit. Let’s assume that she bought her table, blender, and cooler at discounts from her mother for $40. She has no labor costs because she is employing herself. She uses her remaining $120 to buy her ingredients and supplies.

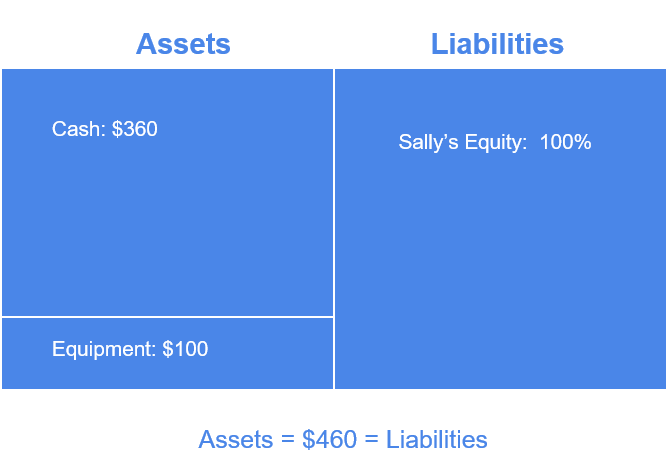

She calculated that she can make a smoothie on average for around $3, and decides to sell them at $6. On Saturday, she sets up her stand and starts making and selling smoothies. At the end of the day, she has used up all her materials and sold 40 smoothies, or $240. Now, Sally’s Smoothie’s assets have increased to $280 from $200 - she keeps her $40 worth of initial equipment, and now has $240 in cash. Saturday was a pretty good day. On Sunday, she sets up her stand again, and buys her ingredients. Sunday is particularly hot, so she buys a $60 tent for her stand to keep herself and her customers in the shade. She then sells out again due to high demand! $180 worth of materials made 60 smoothies, which sold for $360. Now, assets are at $460: $100 equipment, $360 in cash. Sally has done pretty well for just starting out...now she wants to expand. On the next page, we will discuss how she proceeds to expand her business. Below is the balance sheet of Sally’s Smoothies pre-expansion phase.

Expansion

After her first weekend, Sally’s parents were pretty impressed by her business skills. Sally and her parents come to an agreement - a $500 dollar loan financing at 10% interest payable in full at the end of 2 months to help her grow her smoothie business in anticipation of the hot summer months. This means that two months later, Sally would have to pay back $550, but in the meantime, she can invest that loan amount into her business. Sally has secured financing from her parents, but she also needs help to work the stand if she wanted to expand.

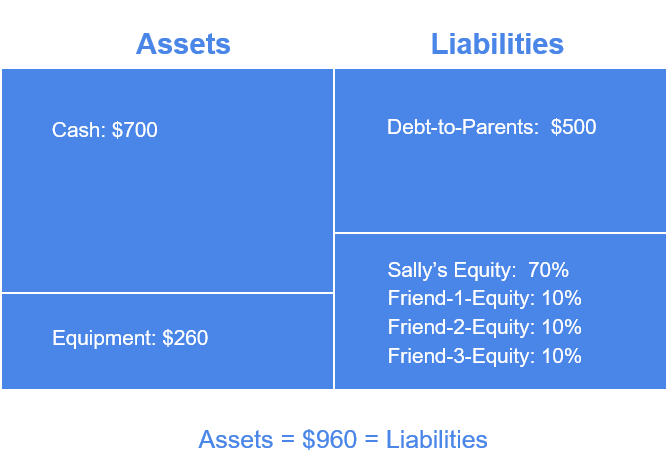

She decides to hire 3 of her friends. Instead of paying them a fixed hourly rate, she wanted to incentivize her friends so that they would all be motivated to sell as many smoothies as possible. She decides to give 10% equity to each of her friends in exchange for their labor. She also needs to buy another table, cooler, blender, and tent which are another $160. This time, she didn’t have mom’s discounts. At the end of her expansion restructuring, but before she begins operations, the asset side of the balance sheet consists of $260 in equipment, $700 in cash. The liabilities side consists of $500 in debt, $460 in equity split 70/10/10/10 among the shareholders. It looks like this:

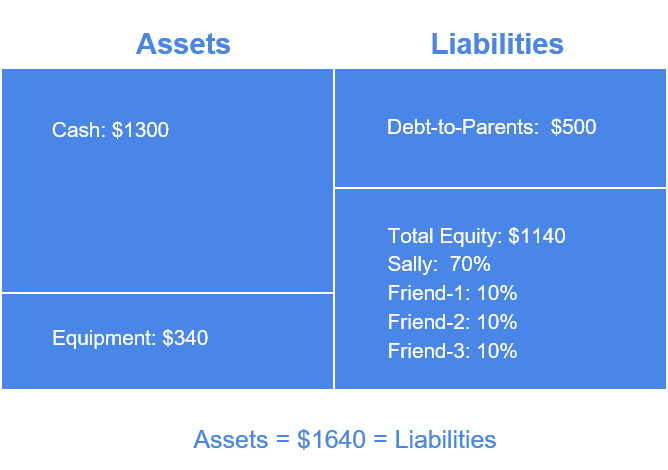

The following weekend, Sally knows that there is a huge soccer tournament going on at an elementary school’s field near her home. It is June, and the broader location fits four entire soccer fields. There are going to be hundreds hot, thirsty kids passing through over the course of the weekend with another few hundred hot, thirsty parents watching their games. Well over a thousand potential customers over one weekend! Sally and her friends set up their two smoothie stands far away from each other so they don’t cannibalize their own business, while still central enough that the kids and customers can reach them easily. With $700 in cash to spend on materials thanks to her parents’ financing, they are able to make about 230 smoothies. At the end of the day, let’s assume each stand sells 115 smoothies over the course of the day, or a 230 total smoothie count. This amounts to $1380 in cash. To prepare for Sunday, the company decides that it can afford to advertise a bit more, so it buys materials for some fliers and posts them near the field. It also buys two megaphones for announcing that their smoothies are for sale. These cost $80, which leaves the company with an ending cash balance of $1300 and equipment of $340.

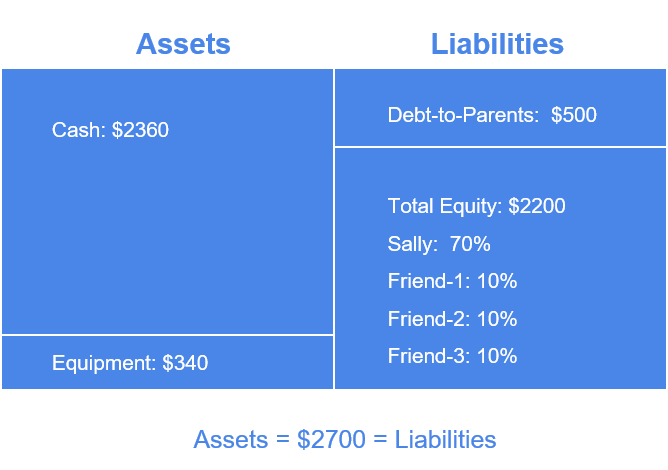

On Sunday, Sally and her friends decide that they feel like they do not need to spend all of their cash for making smoothies because maybe they won’t sell that many, or they don’t have enough hands to make so many. They end up deciding to spend only $1100 of their cash into materials. Assuming that at they sell the smoothies that they want to, each stand sells 180 smoothies, 360 total, amounting to $2160 in cash. At this point, we will summarize the financial situation of Sally’s Smoothies. It has total assets of $2700, of which $340 is equipment and $2360 is cash. It has total liabilities of $2700, of which $500 is debt, and $2200 is shareholders’ equity.

At this point, it is evident that we can really do well if we have a great idea, sell it in the right way, and hire the right people. Investors (Sally’s parents) also helped the business grow by financing it through debt. Sally used “capital markets” to grow her company more than it could have without the financing. Sally also incentivized her friends to help her grow her company, making everyone a bit richer in the process. To illustrate this in numbers, each friend owns 10% of shares. The equity of the business is worth $2200, so each friend got richer by $220 over the weekend, pretty good for a middle schooler. However, it is the majority shareholder, Sally who really benefits from the successful execution of her idea. She owns 70% of the equity of the company, which amounts to $1540. Of course, we assumed a profit margin of 50% ($6 unit price vs. $3 unit cost) which is pretty generous for most companies out there. However, it is not unreasonable, and Sally can always raise her prices to $7 or $8 and still be well worth it for a quality, handmade, fresh smoothie on a hot day.

Review

We have covered the basics of how we think about companies in terms of ownership, structure, and and how money flows through the entity. It is a useful system for those with great ideas to share with the world and at the same time benefit financially. In a world where financial incentives are strong, and sometimes maybe too strong, companies are required to issue statements and reports on their financial situation. This is to disclose important information to the public and to their investors. Even if it is not a public company, financial statements are a useful way to analyze the health and potential of a company. In the next lesson, we will continue with the example of Sally’s Smoothies to illustrate the role of the three financial statements, one of which we have already covered in this lesson - the balance sheet.