Fundamentals

Demand

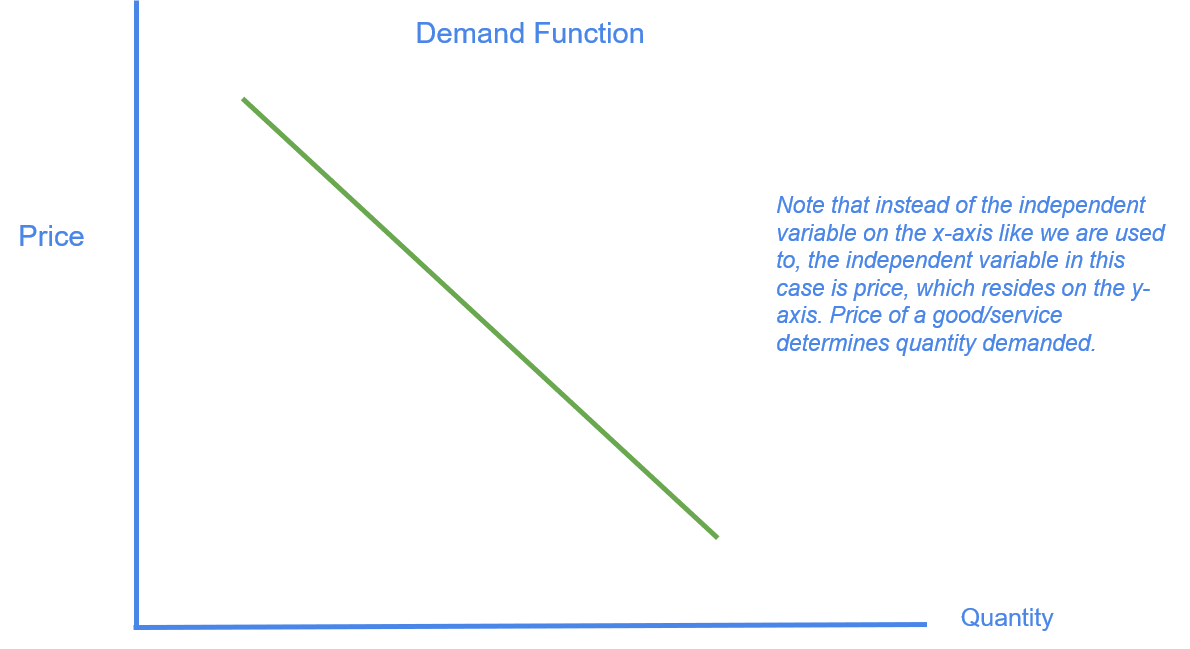

The process of investing requires a baseline knowledge of economics. At this base is the concept of Demand and Supply. The demand function (a line) can be summarized as a function relating price to quantity consumed. It is usually downward sloping because at a high price, fewer units of a product are consumed while at a low price, more units of a product are consumed. For example, we would buy more chocolate at $10 per pack than at $20 per pack, all else equal. One demand function (line) illustrates quantities consumed at various prices. When demand increases, we do not shift along the line, but the entire demand function-line shifts because at a given price, more quantity is consumed in the second scenario than in the first. For example, instead of one person buying chocolate, now there are two people buying chocolate.

Supply

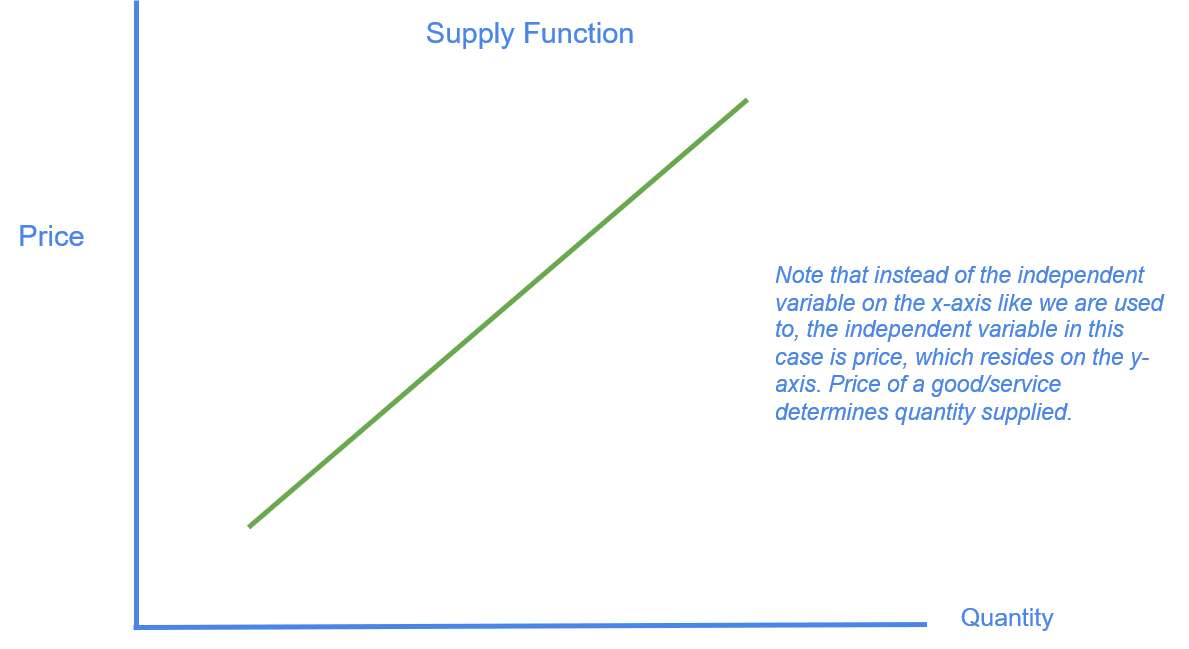

The supply function can be summarized as a function relating price to quantity produced. It is usually upward sloping because at a high price, it is more profitable for a company to produce more while at a low price, it is less profitable so it produces less. For example, a company producing chocolate would want to produce more at $20 per pack than it would at $10 per pack, all else equal. One supply function (line) illustrates quantities produced at various prices. When supply increases, we do not shift along the line, but the entire supply function-line shifts because at a given price, more quantity is produced in the second scenario than in the first. For example, instead of one company producing chocolate, now there are two companies producing chocolate.

Equilibrium

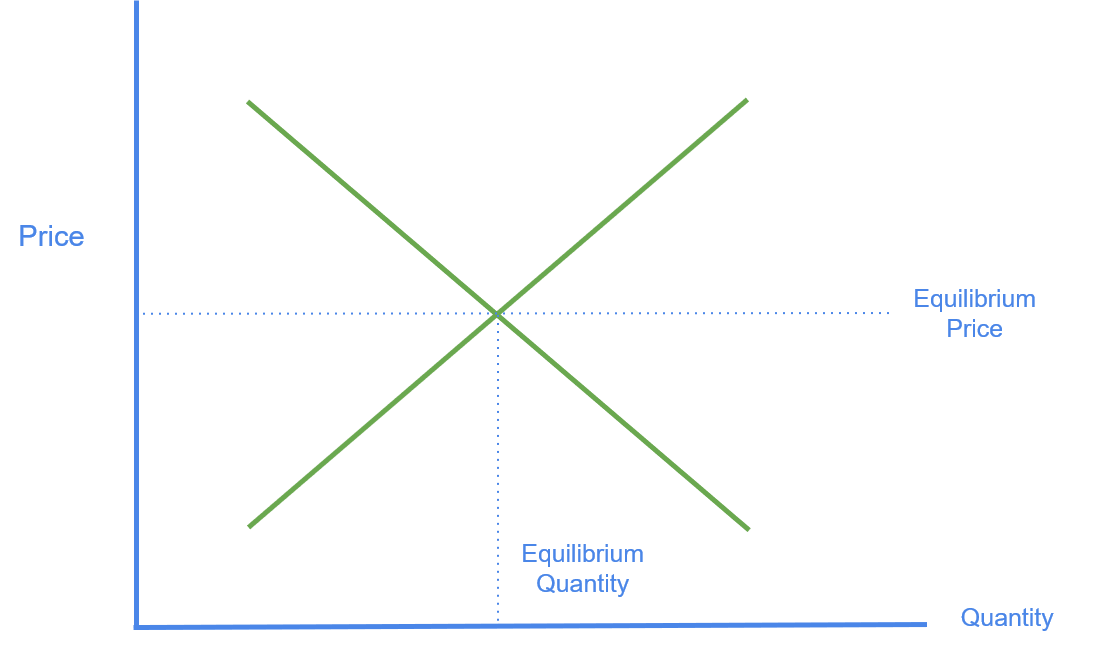

The concept of equilibrium is an idea that at a certain price, the quantity that consumers want to consume would match the quantity producers want to produce. For example, if we assume the equilibrium price of chocolate is at $10 per pack. If it was higher, producers produce more and consumers consume less, leading to an excess. If it was lower, consumers would want to consume more than producers want to produce, leading to a shortage.

Applications

In the real world, this concept can apply to many different products and services with varying degrees of effectiveness, but we can generally say that the broad pattern holds true. We can think about many things in terms of demand and supply, such as oil, gold, computers, avocadoes, and skilled coders.

Efficient Market Hypothesis

There is a theory in the investment world called the Efficient Market Hypothesis that stock prices fully reflect all the relevant information in the world about their true value, and that the market is an accurate reflection of the true value of that stock - it is an efficient market. Of course this is not always true, but it is a useful perspective from which to view investments. Investing essentially boils down to determining which prices accurately reflect the true value of an asset, and which assets are mispriced. Another interesting related idea is that there is no free lunch in economics. It can be illustrated by this scenario:

Imagine an economics professor walking along a well trodden walkway of a college campus. He stumbles upon a 100 dollar bill laying down on the walkway. He thinks, with so many poor, hungry, college students on this campus, there’s no way somebody hasn’t already picked up a real, free hundred dollar bill, so it must be fake. He proceeds to walk by and onto his next lecture. This is analogous to the efficient market hypothesis in the sense that the students are the market participants, and the professor believes the market’s view that there is no real value in that 100 dollar bill. Of course, the investor’s job is to determine whether the free cash is real or fake, and whether other people are mistaken.

Expectations vs. Reality

In the real investing world, there is always a push-pull between expectations and reality. Good news is not as good of news when the market is already expecting good news. Good news is great news when the market is expecting bad news. Bad news is not so bad when the market is expecting bad news. Bad news is really bad when the market is expecting good news. Assessing an asset’s theoretical value is not enough - it is also important to keep in mind the market’s perception. Anyways, enough about investing...back to economics, the focus of this lesson.

How to Measure the Economy

Unemployment

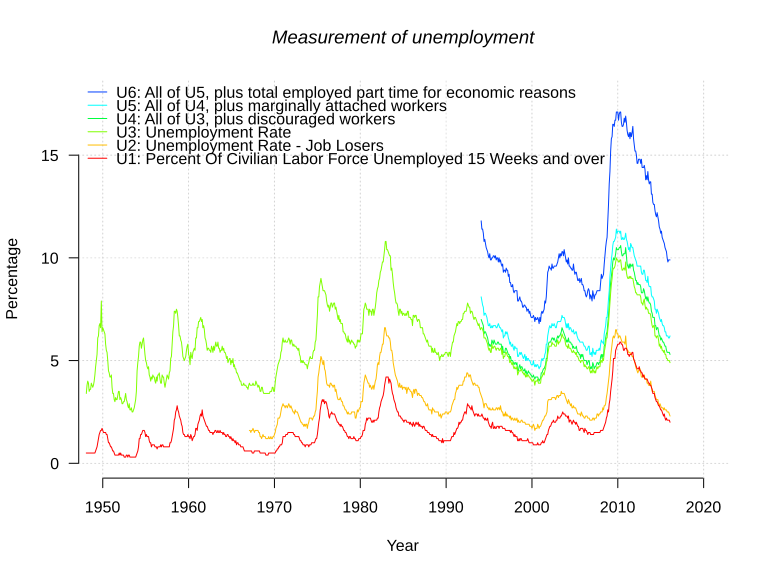

The health of an economy can be measured in many ways. One focus of metrics is on the labor market - the workers of our economy. There are many definitions of unemployment depending on who we include in the labor force, but the most commonly used one is the U-3 unemployment rate, which we encourage you to research more if interested. Employment is the basis of our economy. Workers earn wages to have the money to spend on consumer products and invest. They provide companies the labor necessary to produce products and services. When people are not employed, people consume less, invest less, and the whole cycle is disrupted. Generally, lower unemployment rates are better for the economy.

GDP

Gross Domestic Product is a widely accepted metric of the productivity of a nation. Generally, a growing economy is desired because it means more wealth for everyone. Economic expansions and contractions are measured using GDP. The formula for calculating GDP is:

- GDP = C + I + G + NX

- C is personal consumption expenditure

- I is business investment

- G is government spending

- NX is net exports, or exports minus imports

Other metrics include interest rates, inflation, industrial production, labor force participation rate, etc. These are all important to painting a full picture of the economy, but we will use unemployment and GDP as the main metrics of the state of the economy.

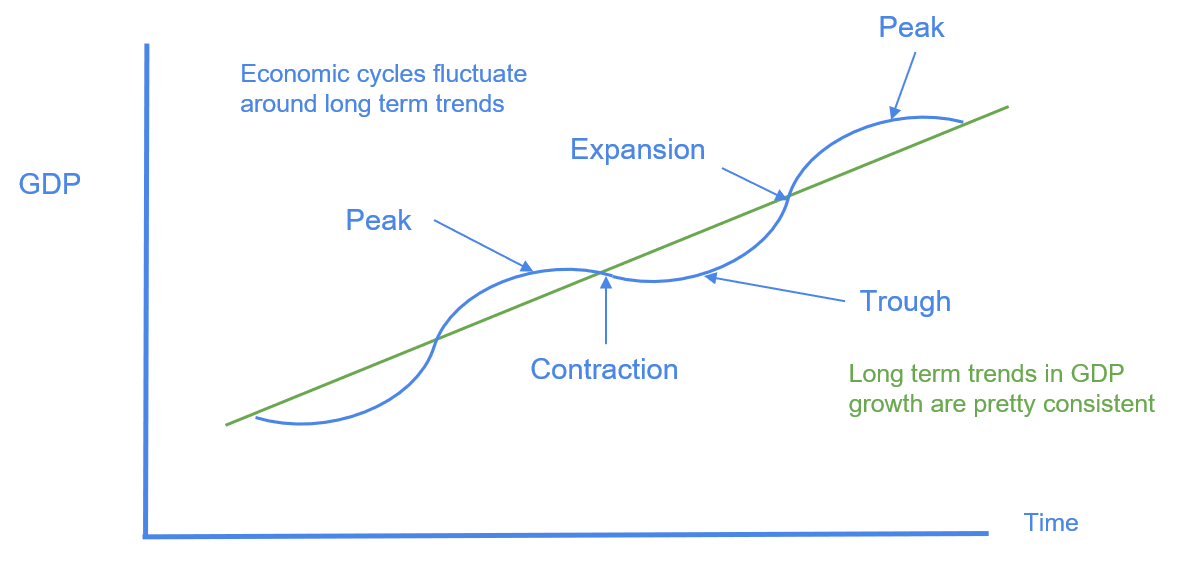

What are Economic Cycles?

As much as we would like in an ideal predictable world, the economy does not grow in a steady, straight line to the sky. During its march to higher productivity, there are some periods where productivity climbs consistently at a fast pace, and others when the economy takes a breather and event contracts. These expansions and contractions form cycles over the years. The role of government and central banks is to smooth out these cycles as much as possible, preventing recession as well as unsustainable rates of expansion.There are different theories as to why these cycles occur, but many economists agree that despite the idea of the invisible hand, human psychology and herd behavior will from time to time feed a trend or hype to an extreme leading to excess pessimism or optimism.

Expansion

The economy as measured by GDP grows during expansions, and with it several other trends. Benchmark interest rates are rising during this period because economic conditions are improving, thus demanding a higher expected rate of return on investments. Rates also tend to rise due to inflationary pressures that build up as wages improve and companies hike prices of the products in response to high demand and higher costs of wages. A safer economic environment leads to increases in lending and borrowing. Unemployment rate decreases.

Peak

Near the peak of an economic cycle, benchmark interest rates are usually at their highest because the expected rate of return is “as good as it can get.” The credit cycle nears its end as lending and borrowing slows, burdened by high amounts of debt. Companies slow down hiring, wages increases, and price hikes because the demand for their products is not as strong anymore and they can’t afford to increase their labor costs. The economy - investor, consumer, banks, and corporations - all enter into a more conservative mindset, a risk-off mode. Unemployment rate bottoms.

Contraction

As the economy rolls over the peak into contraction, benchmark interest rates drop as the Fed lowers the Fed Funds Rate and expectations of future rates of return diminish in the face of a weaker economic outlook. Companies deleverage, lay off workers, and some go bankrupt. Consumers spend less and save more as some lose jobs. Mild deflation might occur from excess supply of goods and services and not enough demand. Unemployment rises.

Trough

The bottom of an economic cycle is known as a trough, and generally at this stage, GDP is at the lowest point. Benchmark interest rates are bottoming out as expectations are depressed and fear is at its highest point in stocks and bonds. The Fed and government have likely by this point enacted some combination of monetary and fiscal policy, which are explained in detail in the lesson The Federal Reserve. Unemployment is near its peak.

Economic Philosophies

In light of observations of economic fluctuations over the centuries, politicians, social scientists, mathematicians, and variety of other figures gradually begin to develop philosophies and theories trying to explain why their countries experienced times of financial prosperity and hardship. In trying to describe these patterns between society and finance, the early roots of the study of economics took root. At its surface, economics seems to be a lot about numbers, but at its heart, it is people who drive the interactions and decision making, and thus it is more so a social science. In the past few centuries many theories and versions of these theories have emerged, but in this lesson, we will focus on two: Classical economics and Keynesian economics.

Classical

In the classical train of thought in the 18th-19th centuries, markets are self-regulating and best left alone without interference as free markets. The bad ideas will earn no profit, the good ones will be rewarded. Resources will be allocated efficiently based on a market determined price, reflecting to whom they are of most value. Individuals and companies as investors all acting concurrently make better decisions than a government deciding for them. For much of the time, this theory seems to accurately describe the average, smoothly functioning economy.

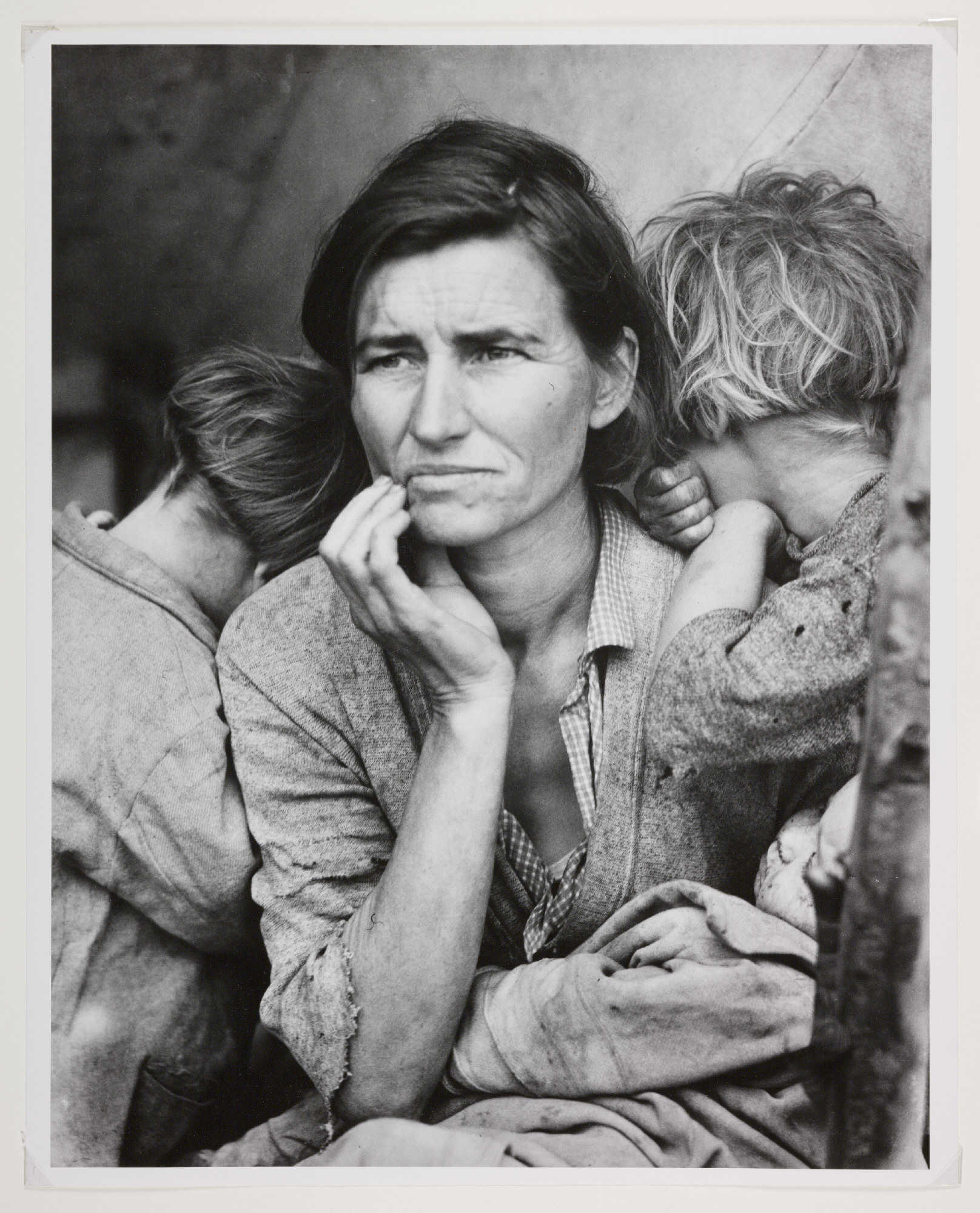

Keynesian

In face of the Great Depression in the early 1930s, a British economist, John Maynard Keynes, proposed that markets do not always return to a benign state in the short to medium term when left to its own accords. He reasoned that total spending or aggregate demand in the economy, including government spending, is what drives production and growth. Therefore, when markets go astray into a negative spiral, government needs to step in to fill the gap in aggregate demand left open by the private sector. In contrast to a purely free market thinking, Keynesian economics advocated for the role of government regulation of markets through fiscal policy, or government spending. Eventually through the New Deal, Americans were slowly able to climb out of their hardship.

Cycles and Investing

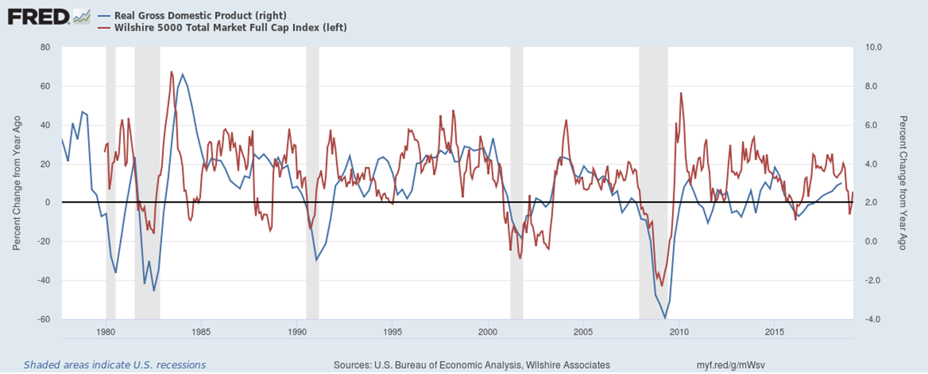

Correlation Between Cycles and Stocks?

Fundamentally speaking, stocks represent the ownership of companies, which are a key pillar of the economy. Thus, it makes sense that the stock market rises and falls with the broader economy. However, because stocks are traded as securities - something you can’t exactly do with the broader economy - they are more susceptible to the whims and excesses of human psychology. While generally reflective of the economy, the stock market performance do not exactly match the timing of economic cycles.

Credit vs. Equity Cycles

The overall bond market is much larger than equity markets, but this distorts the picture a little bit because it includes government bonds. If we think of credit cycles vs. equity cycles, these two mechanisms paint two side of the same corporate coin. While both are subject to excess and speculation, the credit market more directly reflects a company’s operating cash flow since companies are obligated to pay their debt! Even if it’s an established company with a great brand, if it can’t pay its debt, its equity holders are in trouble since debt holders have priority in getting paid. We will cover capital structures in more detail in the lesson What is a Company.

Cycles Domestic and International

While citizens of a country would correctly be focused on companies within their own country, in a world where globalization is the prevailing trend, many of the domestic companies we are familiar with derive much of their revenue from overseas. Consumer product companies like Procter and Gamble, Starbucks, and Microsoft derive much of their revenue from other countries. This means that even if the U.S. economy is doing well, the companies might not post great sales numbers if the economies of the other countries they operate in lag behind. In a world very much linked, a major economy can prop the world economy up, bring it down, be propped up, or be brought down.

Review

Economic cycles provide a context for investing that is valuable when taking a broader look at what we are investing in. When we make a vacation plan to frolic in a field of flowers, we should not only be concerned with which fields are the most beautiful, but also the season, so that when we go and pick flowers, we are not choosing from a bunch of dried twigs in the dead of winter. Next lesson, we will expand on the concept of interest rates.