Review of F.F.

To begin this lesson, we will review two functions of the Federal Reserve that were covered in Finance Fundamentals. One function of the Fed is to provide financing services to the Treasury Department of the U.S. Government. The New York Federal Reserve Bank issues government bonds on behalf of the Treasury to primary dealers who then distribute them to other investors. The second function covered is its role as the banker for other banks. This is the case when banks deposit their required reserves at the Fed to earn a return at the fed funds rate. To understand the mechanics of this more, on the next page, we will cover the structure of the Federal Reserve System.

Structure

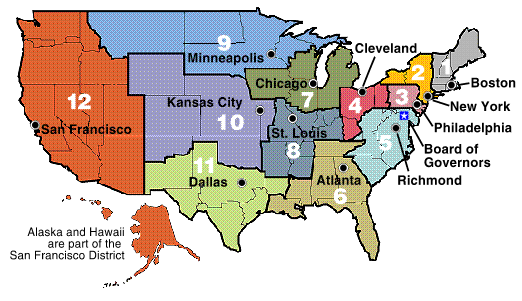

What is often referred to as the Fed in finance is actually the Federal Reserve System, set up in 1913 by an act of Congress. It is under the umbrella of government, but does not derive its funding from government. Three of its main components are:

- Federal Reserve Banks - The system breaks the U.S. down into 12 districts. Each of these districts has a Federal Reserve Bank responsible for implementing rules, regulations, and services to banks in their respective districts. Each regional Reserve Bank has a president, which is also the CEO of the bank. Of the 12 presidents of the regional banks, 5 are chosen to sit on the FOMC.

- Federal Open Market Committee - The FOMC is a committee composed of 12 members, 5 of which are regional bank presidents and the rest from the Board of Governors. This committee sets monetary policy into action by conducting open market operations which influence the fed funds rate and supply of money in the economy. It meets several times a year to reassess economic stability, its goals, plans, and to come to a consensus on decisions.

- Board of Governors - The board performs various tasks within the Federal Reserve System, but its impact is felt strongly because of its presence on the FOMC, which sets monetary policy. The president of the United States nominates the chairman and vice chairman on the board, subject to Senate approval. Governors’ terms span across different presidential terms.

Dual Mandate

Upon the its creation by the Federal Reserve Act, the Fed tries to accomplish two objectives, which is commonly described as the dual mandate.

Unemployment

The first objective is to maximize employment. A healthy economy has few idle citizens, and those who want to work have work. Not only is it beneficial for citizens to be employed, the quality of jobs should be high. This means reliable, full time jobs should be valued more highly than temporary, part time jobs. A good match between employee skill sets and skills needed by employer is also important. We wouldn’t want people doing work that they are not trained in because they can’t find a job anywhere else.

Price Stability

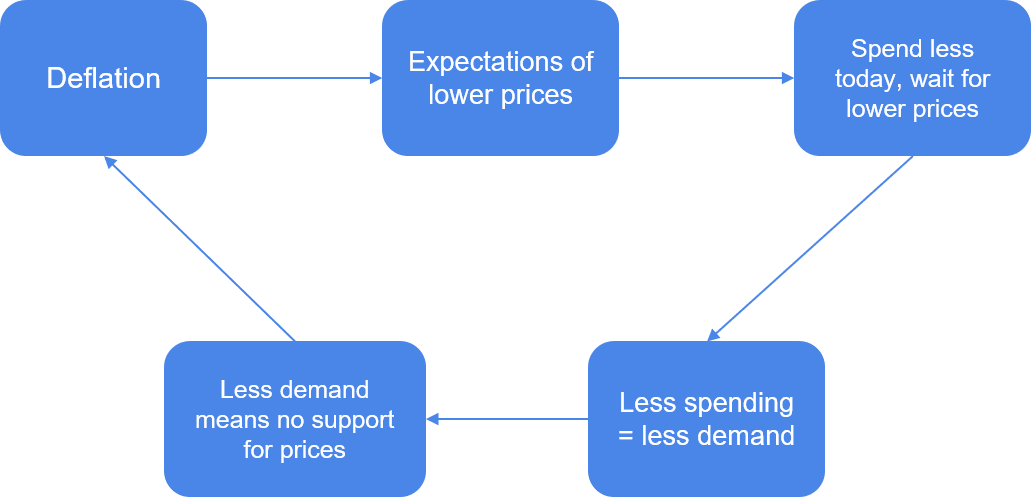

Stability in prices means predictability for consumers. An ideal stable price trajectory would be a low but positive inflation rate. Too much inflation is bad if the prices of everything we purchase keeps on shooting up. Despite that we might think lower prices are good for us in the short term, long term deflation is also not ideal because if people thought prices will keep on decreasing, then it would make sense to save money for later and not spend any today. If this was the case for a lot of people, then spending would grind to a halt, companies would lose their revenue and ability to pay their workers, and workers with no pay will spend even less.

Economic Policies

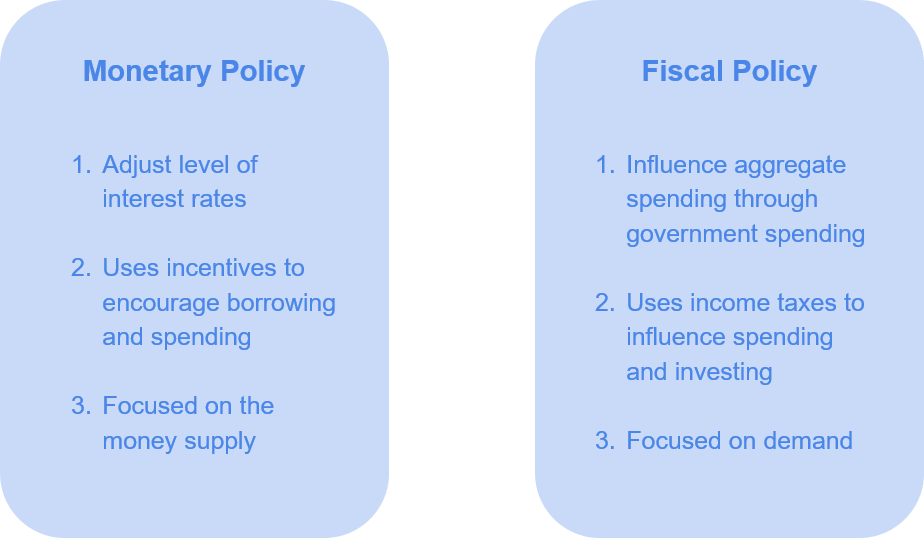

Fiscal

Fiscal policy refers to tools that governments can use to increase aggregate demand in the economy, an idea pioneered by Keynes. These tools include changes in taxation and government spending. By reducing taxes on either consumers or businesses, this provides to them more spending power and thus increasing demand. By increasing government spending on various types of projects like Franklin Roosevelt did in the New Deal, this puts money into the pockets of consumers and businesses to invest and spend. The when the government itself spends, it is increasing the aggregate demand of goods and services in the economy. For example, if a it set out on a project to build hydroelectric power plants, this is a demand on labor and a demand on services provided by construction companies and raw material suppliers.

Expansionary policies like reducing taxes and increasing spending spur on the economy to grow by increasing demand. On the other hand, if government thinks the economy is doing well or overheating, it might press the breaks on its spending or even raise taxes. However raising taxes is sometimes political suicide, so this doesn’t happen too much.

Monetary

Monetary policy refers to tools used to incentivize consumers and businesses to spend more instead of directly affecting the spending. It is less interventional, but also changes the behavior of participants in the economy in a fundamental way. This is usually done by the Fed using the various tools it has at its disposal to affect the money supply and economic incentives. If we can get away of making an analogy on this, fiscal is like force feeding a child to eat vegetables - you know that he is getting the nutrition but he might not be happy. Monetary is like giving him a dollar for every vegetable he eats - you know that logically, he will eventually eat his vegetables, but you don’t know how many dollars you might end up having to give him.

Expansionary policies like lowering interest rates increase borrowing and spending in the economy. On the other hand, if the Fed thinks the economy is doing well or overheating, it might raise interest rates to slow down credit creation (borrowing). However, if it raises rates too quickly, it can accidentally decrease borrowing to an unhealthily low level, and plunge the economy into a downward trend.

Federal Reserve Tools

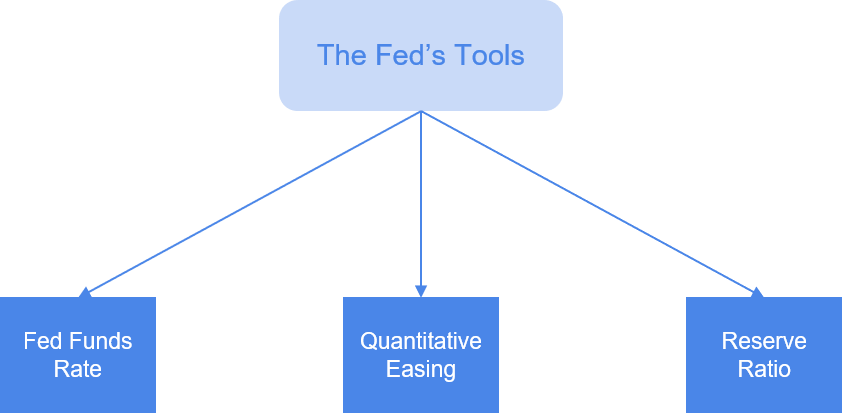

Fed Funds Rate

The primary tool of the Fed is raising and lowering the fed funds rate. This rate, which is the benchmark rate at which banks get paid on reserves held at the Fed and on loaning each other money is closely related to short term treasury yields. This is because both of these are essentially risk free - the chances of the U.S. Government defaulting are very low, as well as the chances of major banks or the Fed not being able to pay back overnight loans. This is why the short end of the treasury yield curve reacts more strongly to Federal Reserve interest rate decisions than the long end of the yield curve. By short end, we mean short term, or short maturities, and long end, long term, long maturities. If not familiar, please review the yield curve section in the lesson Interest Rates.

QE

A more recent and unconventional tool that the Fed has used is called quantitative easing, or QE. Quantitative easing is the practice of buying long term debt assets such as treasury bonds in an attempt to drive down long term interest rates to stimulate borrowing. In essence, it is generating demand for long term debt, making it easier for borrowers to borrow money. Easier access to funds is essentially increased money supply, a hallmark characteristic of monetary policy. However, in contrast to traditional targeting of short term interest rates, long term interest rates are more reflective of inflation and growth expectations. Deviation from the natural rate defined by the market instead has unclear consequences for investors and the economy, despite it being a temporary solution.

Reserve Ratio

The reserve ratio can be changed to influence money supply as well. Increasing the required amount of reserves banks must park at the Fed will allow banks to lend out less, making it harder for people to borrow. Although in theory this is possible, in practice, the reserve ratio is infrequently changed, leaving the fed funds rate as the main policy tool.

The Fed and Investing

Bonds

Short term “risk free” interest rates serve as a floor to all other interest rates. When yields on treasuries rise, they generally push other types of yields like muni bonds, corporate bonds, and high yield up as well. However, this floor becomes less relevant as we head to longer maturities, since longer maturity debt serve to reflect growth and inflation expectations. If it is perceived that raising short term interest rates hurts will hurt growth in the longer run, long term interest rates might not rise as much, or might even fall. Note that when the Fed reaches a decision to raise or lower rates, it can be referred to as a hike or a cut.

Stocks

How well the stock market reacts is also a reflection on economic growth. If a rise in the fed funds rate is perceived to reflect a healthy economy, the stock market might react positively. However, if the Fed hikes and it is perceived as a mistake, then there could be a negative reaction.

Gold

It is a complicated story for investors because trading is highly driven by emotion and sentiment. It is also such an international asset that its value from currency to currency varies a lot. In the U.S., a strong dollar is negative for gold, because why would we invest in gold when there’s a good economy and other higher yielding assets? Note that a strong currency means there’s a high demand for that currency, reflecting higher yields compared to other currencies and a strong economy. Because of this, fed rate hikes in theory are negative events for gold. However, it is a two sided story because rate hikes are to counter inflation, for which gold is a common hedge. Since gold is a physical asset, rising prices don’t affect its actual value, resulting in it often being used as a protection against inflation. Since inflation is theoretically good while hikes are theoretically bad for gold, these two which often come in tandem can cancel each other out.

Expectations vs. Reality

In the end, any asset trades in reaction to the difference between expectations and reality. If the Fed was expected to hike, and it hikes rates, then not much would happen. If the Fed was not expected to, and it hikes, the reaction could be pretty negative.

Review

The Federal Reserve, as the central banking system of the United States, plays a central role in both the economy and investing. Having a better understanding of how our financial system is regulated is crucial to investors who want to effectively interpret the meaning of policies and respond in a smart way. Regarding personal finances, the Federal Reserve’s decisions impact the rates we get as borrowers seeking mortgages, personal loans, as well as other financing options. With a combination of understanding of economic cycles, interest rates, and the Fed’s influence, we can began to delve into the process of investing itself.