Time Value of Money

There are several ways to think about interest rates. Many are insightful, but only appropriate depending on the situation. However, having a framework from which to think about interest rates is useful going forward in both investing and our personal finances in the real world. One overarching concept of interest rates that applies to a broad range of situations is the time value of money. Within this framework, we can divide it further into four interrelated concepts:

- Opportunity Cost

- Expected Rate of Return

- Discount Rate

- Risk and Reward

Opportunity Cost

One way to think about interest rates is the opportunity cost of investing money in one thing instead of another over a period of time. Let’s imagine Bob earns $1000 in a month at his part time job. He has the option to invest that $1000 dollar into a bond that yields 4% over 12 months or 6% over 24 months. The opportunity cost of investing in the 24-month bond is what Bob is what he could have earned choosing the other investment, which is a 4% annual yield. The opportunity cost of investing in the 12-month bond is what he could have earned choosing the other investment, which is a 6% annual yield. All else equal, Bob prefers to minimize his opportunity cost, or essentially FOMO, over a given period of time.

Expected Rate of Return

Another way to think about interest rates is the expected rate of return in a given environment. For example, when we are holding cash in U.S. Dollars, we should expect to generate an interest return of at least the rate of inflation. Let’s say this is 2%. We would expect a normal, moderate, functioning economy to have a return on cash equal to the rate of inflation. If the rate of return was lower than inflation, people would flock to other currencies that have a return higher than inflation, decreasing demand for USD, leading to its devaluation and more inflation. What can we invest in to achieve this expected rate of return? Treasury bills that are short term, issued by the government, and essentially risk-free might be able to achieve this 2% annualized rate of return. While the Fed actually targets the fed funds rate to achieve price stability, short term Treasury bills have yields that are closely tied to the fed funds rate. This rate can change depending on the environment and the asset type. A long term treasury bond will have a different expected return in a strong economy than in a weak economy, all else equal.

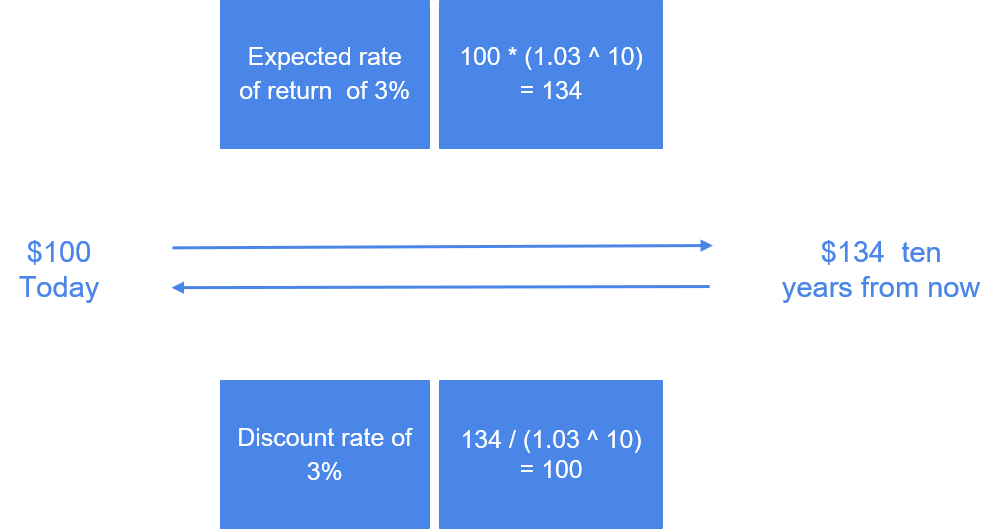

Discount Rate

A similar concept to the expected rate of return, the discount rate reverses the direction from which we are looking at things. When we think of expected rate of return, we think of a return we expect to get in the future. For a discount rate, it is looking at a price in the future and discounting it back to the present. Mathematically they are approximately the same depending on benchmarks used, but conceptually, they are used a little differently. For example, with an expected rate of return of 3% on an investment, we expect this investment to compound at 1.03^n for n years. For a discount rate, if we expect to receive $100 ten years from now at a discount rate of 3% over that period, that $100 will be discounted by 1.03^10 to the present, meaning the present value is only $74.41.

Risk and Reward

Lastly, the concept of risk and reward will be something that reappears over and over again in both finance and our daily lives. If we were confident enough in our wisdom, we would deem it a rule of life. The key is to know when to take the risks, and when to just play it safe. Here are a few examples:

- Career - choosing to do what you really love may not make the most money at first, but the potential rewards in getting it right are immeasurable.

- Sports - a team always playing it safe will rarely win championships, but probably achieves solid results from season to season.

- Arts - an artist that paints with the prevailing trends will sell his artwork well, but might not be deemed extraordinary.

- Dating - higher (perceived) chance of getting rejected when approaching a crush, but lots of joy as a reward otherwise.

- Investing - consistent moderate returns, or potentially high returns with volatility.

- Cinematography - Walt Disney could have gotten a “real job” in his day working at some place like a factory like most of his peers. Or he decided to make a career out of drawing cartoons.

Treasury Yield Curve

Treasury debt has different maturities - the length of time a bond is issued to be outstanding before the principal, or amount initially borrowed, has to be paid back. Treasury debt comes in:

- Bills - maturities of a year or less

- Notes - maturities of 2 to 10 years

- Bonds - maturities of more than 10 years

Although referred to by different terms, in this lesson we will refer to all treasury debt as short, medium, or long term treasury bonds for simplicity’s sakes.

Short term vs. Long term treasury bonds

In treasury bonds as well as all investments, there is a risk-reward dynamic with regards to duration of the investment. If an investor is tying up his(her) cash for a long period of time, he is taking on more risk than if his cash was only tied up for a short period of time. However, this risk is less due to default risk, than to another type of risk - inflation risk. If inflation rises, then bonds will need to offer higher interest rates to be attractive, making the current bonds’ interest returns unattractive by comparison. This is why the extra risk inherent in longer term treasury bonds is reflected as higher yields (we will always refer to annualized yields, not total return) in the treasury market. If the reasoning is not obvious, think about it this way: if an investor can get a yield of 2% per year for 2 years, why would he tie that money up for 20 years at only 2% per year? He would just roll over the 2 year bond 10 times instead, taking on less risk than he would in tying up his cash in one 20 year long investment.

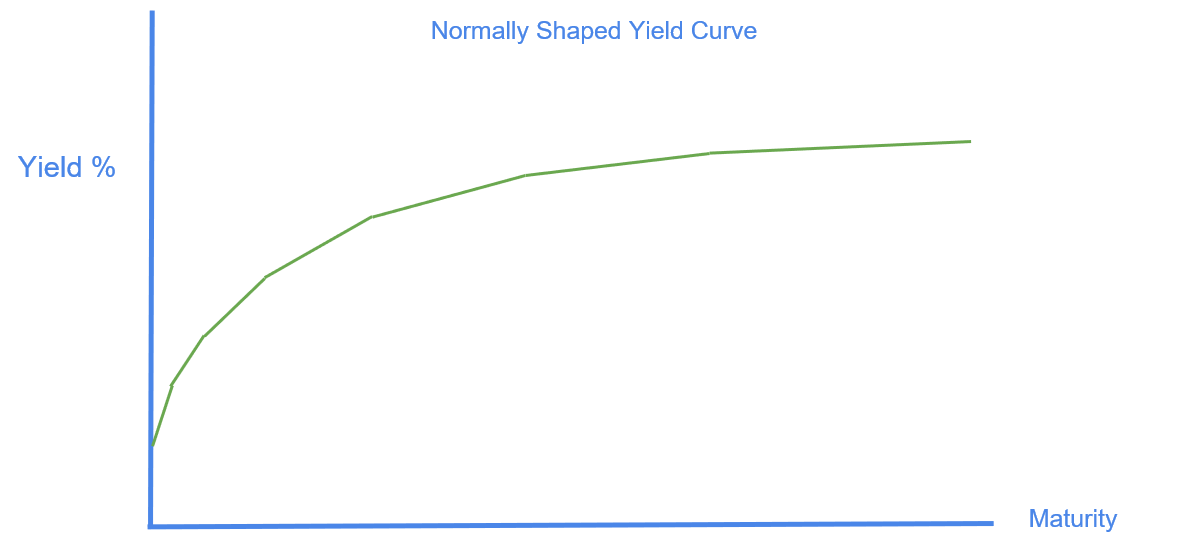

If we plot the treasury yields of treasury bonds on a graph with the x-axis independent variable being the maturity of the bond and the y-axis dependent variable being the yield, then this shows a relationship between maturity and yield.

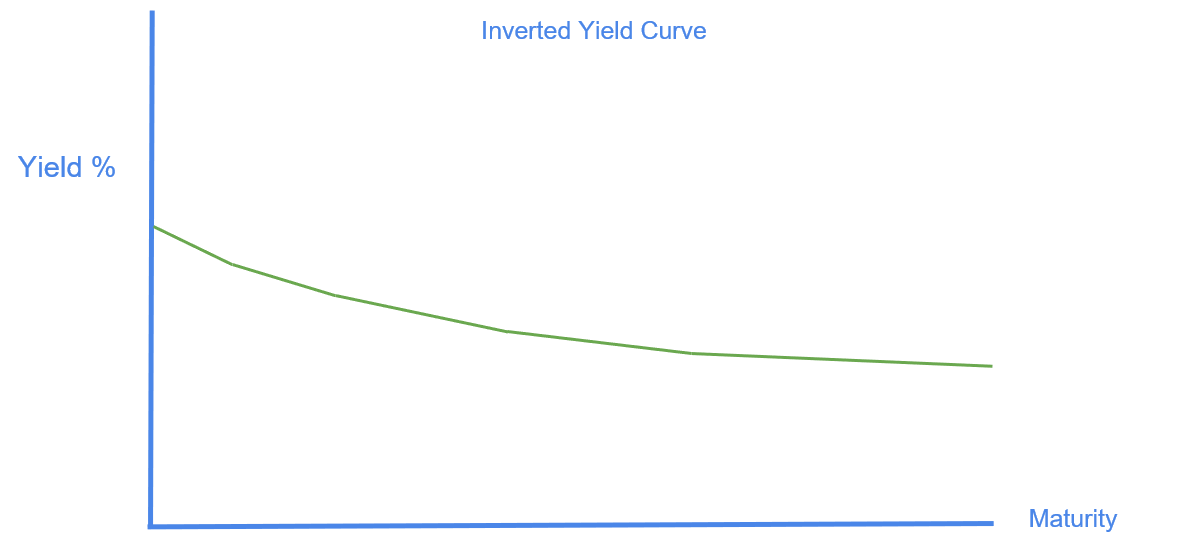

In a normal yield curve, the yields are as we expect them to be - higher for longer term because more risk over time, and lower for short term because lower risk over time. But sometimes, the slope of this line flattens out or even inverts! Before we get to reasons - what does this reflect?

A higher yield in a short term treasury than a long term treasury is a product of lower interest rate expectations in the medium to longer term. Why is this?

If an investor expects longer maturity bonds to have lower interest rate yields in the future than at present, it would make sense for him to buy those bonds to lock in that investment return. The more people that buy these bonds, the higher the demand, driving price up and therefore yields down. The shorter term bonds do not move as much due to interest rate fluctuations because an investor would get his money back relatively quickly, meaning interest rate fluctuations matter less in the meantime.

Why would investors expect lower interest rates in the medium to longer term? It is a mix of reasons, but two interrelated important reasons might be:

- Expected Rates of Return - going back to our framework of thinking earlier this lesson, in a economy expected to be weaker, general expected rates of return will be lower.

- Inflation - Because long term interest rates reflect growth (expected rates of return) and inflation (a way of discounting the future value of cash) in an economy, and inflation rarely happens in weak economies (prices can’t rise due to lack of demand), long term bonds won’t have high yields to compensate for expected inflation.

Confused? If you are, we agree with you that it’s kind of confusing. It’s like thinking in circles since everything is so related to each other. To understand the basics of bonds better, please take a look at the lesson Bonds.

Interest Rates and Currencies

Currency Yield

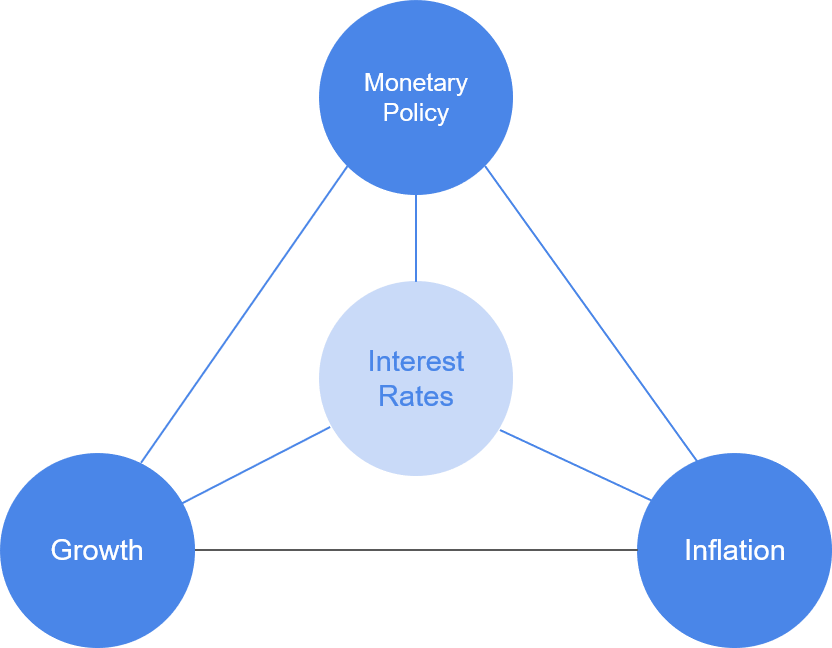

Interest Rates are at the heart of many things, from bond market dynamics to currency dynamics. A currency’s “interest rate” can be thought of as the closest thing to a risk-free asset available in that currency, which is by default that currency’s rate of return. If we wanted to get a risk free return in USD, we would buy short term U.S. Treasury Bonds. If we wanted to get a risk free return in GB Pound, we would buy short term U.K. Government Bonds. The yields on these bonds reflect:

- Central bank policies in their respective countries, which are based on #2 and #3

- Inflation expectations in their respective countries

- Growth expectations in their respective countries

While short term bond yields generally do not reflect inflation and growth expectations directly, they do so indirectly when a central bank raises benchmark rates to combat inflation, which often comes with strong growth.

Now, when we consider cross-currency dynamics, we need to think like an international investor. Let’s imagine a scenario - U.S. short term treasuries are yielding 2% per year while U.K. short term gov bonds are yielding only 1%. We would choose to buy treasuries because we get an extra 1% of return! This means investors will sell U.K. Bonds in GBP to buy U.S. Bonds in USD - in theory, if all else was equal. Of course, rarely anything is “all else equal” in practice since the world is a complicated place. It is just an interesting and useful way to think about things.

Interest Rates and Investing

Bonds vs. Stocks

In the world of investing, it is all about comparing returns. Investors compare returns on investments to see which ones generate the best returns given a certain amount of risk. In asset allocation, interest rates play an important role in determining how investors shift money between stocks and bonds. If a bond is yielding 3% and the stock pays a 3% dividend, both take about 33 years to earn your 100% of your initial investment assuming equal risk. However, if interest rates all of a sudden rise to 4% on that bond, it suddenly becomes more attractive to own the bond than that stock. This is just an example, but applied to the entire stock and bond markets, these gradual changes in interest rates have an important effect on how investors think to value stocks and bonds.

Within the world of bonds, interest rates also have different degrees of effects on the market prices of short term vs. long term bonds. While this has no effect on investors who hold to maturity, many do not and therefore it is of relevance. This will be covered in more detail in the lesson Bonds.

Review

The general topic of interest rates reaches many different parts of finance. While interest rates themselves are just numerical representations of investing returns, conceptually, we can think of them in different ways to help us understand different situations in our daily lives and in investing. The next lesson will focus on the Federal Reserve, it’s role in the economy, its influence on interest rates, and how it affects the investment world.