The Intelligent Investor

Initially published in 1949, The Intelligent Investor is a book written by Benjamin Graham that explains an investing approach nowadays referred to as value investing. Benjamin Graham was an American investor who pioneered the discipline of value investing. He also published an earlier well known book called Security Analysis with David Dodd. He taught at Columbia University as well as at UCLA.

One of his pupils was Warren Buffett, a widely respected investor who is the chairman and CEO of Berkshire Hathaway, one of the largest companies in the world. Buffett and many other value investors learned from Graham’s value investing approach and book, which is what we believe one of the best places to start learning for a serious investor. Its principles have withstood the test of time because it not only taught valuation methodologies - the technical side, but also the importance of character, discipline, and psychology in investing. In this lesson, we will focus on one of Graham’s most elegant allegories - Mr. Market.

Mr. Market

Instead of trying to rephrase a well written excerpt from a masterpiece, we will just cite it here, the quote from The Intelligent Investor:

- “Let us close this section with something in the nature of a parable. Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly.

If you are a prudent investor or a sensible businessman, will you let Mr. Market’s daily communication determine your view of the value of a $1,000 interest in the enterprise? Only in case you agree with him, or in case you want to trade with him. You may be happy to sell out to him when he quotes you a ridiculously high price, and equally happy to buy from him when his price is low. But the rest of the time you will be wiser to form your own ideas of the value of your holdings, based on full reports from the company about its operations and financial position.”

The above quote signals to us the folly of letting market prices affect us too much. Instead of worrying about whether stock prices are rising or falling, we should look at these gyrations as gifts of opportunity. However, since the market can often be irrational for longer that we might expect, we should think cautiously about every small gift that Mr. Market offers us. Instead pouncing at every offering, we should wait until he offers us an opportunity we just can’t pass up! If you enjoyed the quote above and are serious about learning more, we suggest that you check out the book, especially chapter 8, The Investor and Market Fluctuations.

The Real World

Analogies are useful, but how does this play out specifically in the real world? When it comes to single stocks, Mr. Market is the perfect portrayal of how things are. If we see a stock of a great company with talented management trading at a cheap price for one reason or another, it would benefit us greatly to think about investing as owning a part of a company instead of worrying about when the stock will rise. It might turn out to be a week from now, or a year from now. Either way, if we are investing for the long term, we can rest assured that we got great value for a reasonable price. If we are trying to profit from short term price movements, we need to be honest with ourselves in what we are trying to do.

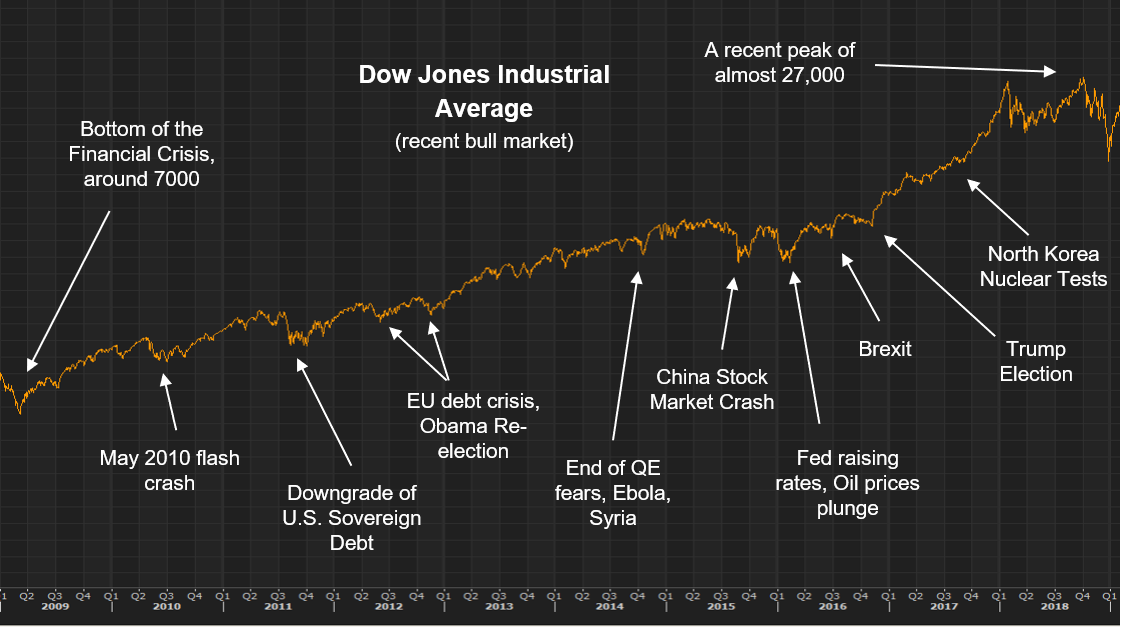

In finance, there’s a popular saying that the market climbs a wall of worry. On this wall, Mr. Market shows us cracks and crevices when he is in a pessimistic mood and thinks the whole world is going to collapse. Little does he know, a few weeks or months from showing us these faults in the wall, it all becomes smooth sailing again. We need to navigate Mr. Market’s panic attacks, and realize that in a bull market, the vast majority of the time, we are fine. It is only when we see the fundamentals being pulled out from under our feet - when the wall is slowly but unmistakably turning into quicksand - that we should seriously consider reducing our exposure and risk levels.

Review

The allegory of Mr. Market is timeless and widely applicable. If we as investors are able to keep a level head and work with Mr. Market to our advantage instead of letting him dictate our emotions, we will find the whole process of investing to be much simpler and manageable. He teaches us that while most of the time markets are efficient in pricing assets, there will be periods of irrationality. How well we navigate these periods is not determined by raw IQ, but rather a stable temperament and a sense of discipline. We don’t want to go on emotional roller coaster rides with Mr. Market!