Intro

In the long term, the fundamentals of a company will trump other factors. However, this can take several years, or even a decade for this to happen, so a fundamental investor should be prepared for the long haul. During the short to medium term however, sentiment often trumps fundamentals. What we mean by sentiment is the prevailing “mood” of investors towards single stocks or the broader market. These sentiment trends tend to last for a while and swing between extremes. There are often periods of prolonged optimism when good news is rewarded and bad news is disregarded. And then rather abruptly for one reason or another, investors decide enough is enough, and good news is disregarded and bad news punishes the stock. We cannot consistently predict what the reason or trigger will be that changes sentiment, but inevitably, stocks and markets don’t go up and down in straight lines. Our job as investors is to identify when the sentiment becomes extreme to a point that the stock price becomes unreasonably dissociated from its fundamental value. An excess optimism warrants selling the stock if we already own it, and an excess pessimism warrants buying the stock for less than what it is worth.

One important thing to note is a famous quote by John Maynard Keynes, the founder of Keynesian economics - “the market can remain irrational longer than you can remain solvent.” This is a crucial idea to understand because the prevailing sentiment may last longer than we would expect. This is also why it is so important to manage risk levels correctly. Imagine we go long a stock or security. It drops 10%, but we still have conviction in our investment thesis. We would like to stick with our investment, but if we didn’t assess our risk-tolerance correctly, then we might be forced to sell at a very inopportune moment. This is why we need to heavily consider prevailing sentiments, and give ourselves a large buffer, or margin of safety, to deal with potentially irrational markets before our investment thesis plays out the way we want to.

For example, imagine that we are elevator designers. We want to design an elevator to hold 10 people - assuming on average each person weighs 150 pounds, it should be able to hold 1500 pounds. However if we put a label saying this elevator can hold 10 people, and 10 people actually get in and they happen to weigh a little more than 1500 pounds, we would be in deep trouble! If we want to support 1500 pounds, we need to give ourselves a margin of safety in case something unpredictable happens. We should design the elevator to hold at least 2000 pounds if we are going to label it as safe for 1500 pounds.

Stock Sentiment

Stock Fundamentals

Sentiment on single stocks comes from a few factors. One of them is the fundamental performance of the company. If a company issues earnings report that beat expectations again and again, and puts up great growth numbers, sentiment is probably going to stay positive with a tenacity. Even the stock has had a big run, if the fundamentals support it, then investors will be inclined to buy the dip. A great management with strong earnings will present investors few opportunities to catch the stock at a cheap price. On the other hand, if there are serious concerns about the earnings growth of a company, those concerns will persist. If it’s not just a one-off earnings miss, but a longer term concern with the performance of a company’s business segments, then the negativity may persist for longer than we might initially think.

News

A second factor that impacts sentiment on a stock is headline news. This could be news about company management, industry competition, political risk, regulatory risk, etc. For most cases, earnings are the most important determinant of stock sentiment. However, if news about a company seems to change its fundamental outlook enough, it will definitely impact sentiment. Even if earnings are good, companies only report earnings quarterly. In the months in between earnings reports, certain positive or negative headline news can produce gyrations in the stock price, even if the news ultimately does not affect earnings in the long term. These types of news events that produce overreactions in stock prices often present great investing opportunities.

Time

With time, stock prices will eventually reach their fair value. However, this might take longer than we might think, especially for smaller, less frequently traded companies. The time that positive or negative sentiment lasts depends on the severity of the underlying factors driving the sentiment. Political news that is only headline risk but doesn’t really affect a company’s earnings tends to impact sentiment for a short time frame. News that do change the picture of a business’ growth prospects tends to impact sentiment for a longer period of time.

Market Sentiment

Market Fundamentals

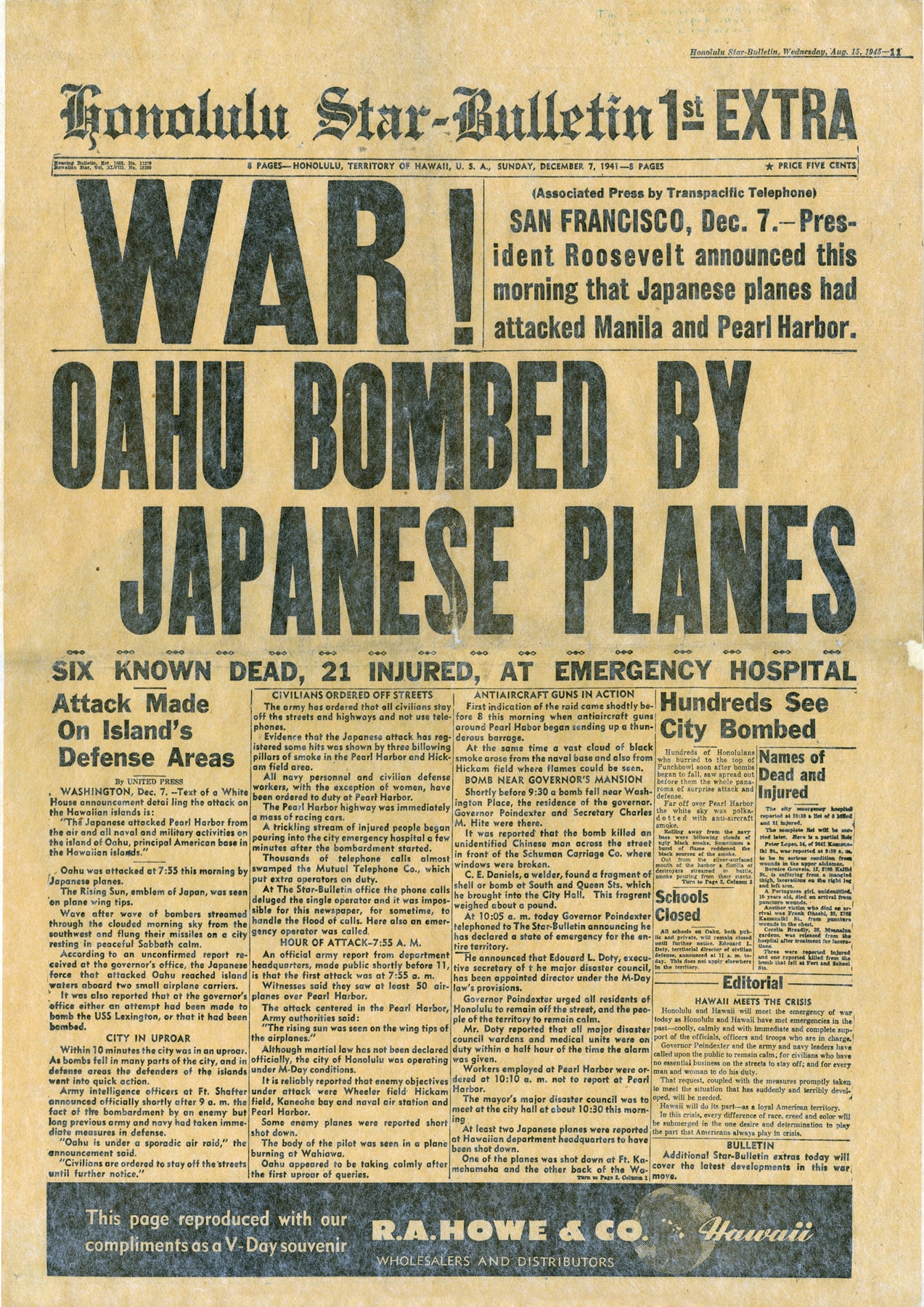

Sentiment of the broader market is primarily driven by market fundamentals. What we mean by this is the health of the underlying economy, interest rate levels, inflation expectations, GDP growth, credit risk, etc. What we would not consider as market fundamentals would be news such as war breaking out elsewhere in the world, natural disasters, political jockeying, etc. These events, while they may have some impact on markets from a perspective of fear levels, do not directly affect meaningfully the underlying domestic economy on a long term basis. An event like a monthly report on job creation is directly reflective of the health of the economy and consequently the stock market. Sentiment that develops from an excellent or horrible jobs report is generally more lasting and pervasive than sentiment that develops from a brief political skirmish with no lasting consequence. Even for serious conflicts, it has to be inherently damaging to the economy to be of concern.

News

Events around the world and domestically that constitute as headline news do have short term impact on markets, but do not have as lasting effects if fundamentals are good. This is more or less political noise and static that drive the day to day fluctuations in the broader markets, but have very little meaningful consequences for companies in the long term. Trying to act, interpret, and predict these types of daily gyrations and market reactions is the job of media companies grabbing viewership rather than the job of serious investors. Short term traders on the other hand may try to profit in this endeavor, but success is far from a guarantee. However, if we as investors have a fundamental view on the economy and see market overreactions to seemingly inconsequential news, we might take the opportunity and benefit from these short term overreactions.

Time

As with single stocks, the broader market needs time to reach fair value. However, instead of viewing a mispricing of the market as a negative thing, it should be thought of as an investment opportunity. After all, if the market perfectly priced everything all the time, then everyone would have the same returns and there would be no chance at outperformance.

Review

To recap, fundamentals determine the long term performance of companies and the broader stock market. Sentiment is often what drives medium and short term trends and movements. As the length of time increases, we have a better chance of correctly navigating trends. It is hard to predict how the market trades from one minute to the next, a bit easier for day to day movements, and still a bit better for trends lasting a few weeks to months. Predicting performance of stocks or the market is actually rather difficult a year or more out, but the economy can be a general guide in navigating markets. We cannot predict with consistency the exact performance of stocks and markets, but we can make educated decisions on the price we are paying and the value we are getting for an asset. In the next lesson, we discuss an idea called “Mr. Market.”