Types of Analysis

With regards to doing analysis on stocks, there are are two common approaches: fundamental analysis and technical analysis.

Fundamental Analysis tries to assess the value of a company’ stock at a fundamental level, thinking about how much it is worth through various calculations or comparisons.

Technical Analysis, on the other hand, not as concerned with the underlying value of a stock. Instead, it is focused on trends, patterns, and characteristics in the way a stock trades.

While there are staunch supporters of each camp, fundamental analysis is a more time-tested and mainstream method of understanding stocks. However, fundamental analysis on its own often leaves research analysts baffled by unexplained and seemingly irrational moves in stock prices. This is where technical analysis provides some perspective. When combined with fundamental analysis, it can serve to give investors a better picture of market dynamics. Below, we will discuss some real world applications.

Earnings Reports

When a company reports earnings - usually quarterly - sellside research analysts often update their ratings and price targets after the earnings report is released to reflect changes in the company’s outlook. While at the surface this seems reasonable, there are times when it is not so useful. If we think about it, sellside research analysts’ jobs are to understand a company, speak knowledgeably about its operations and management, and publish research reports on it. If they are selling their research, then it should add meaningful value to an investor’s decision process.

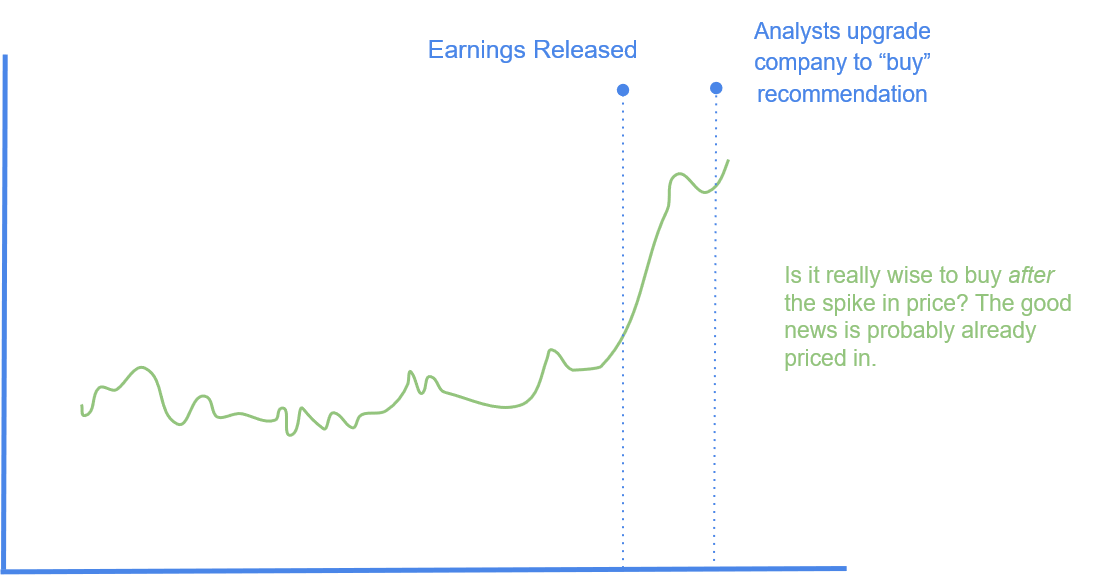

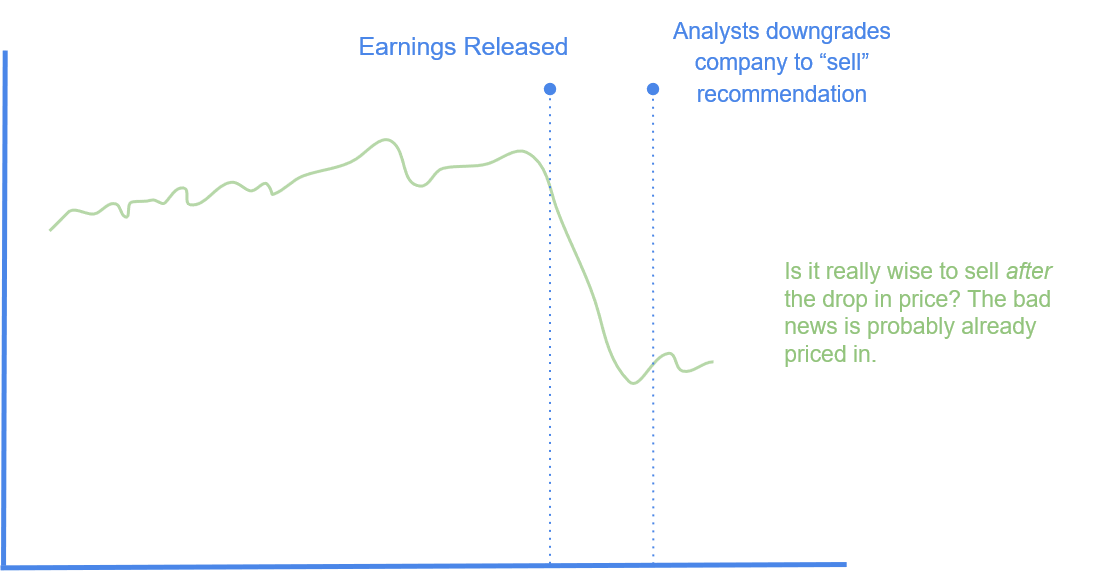

Imagine that a company reports great earnings and the stock shoots up in price. Then the research analyst upgrades the company to a buy and lifts the price target. What value does that analyst add? The analyst is just telling us what we and the market already know. By the time the analyst upgrades, the stock might have already increased 5% and priced in all the good news. If we were to think “oh the company issued great earnings, we should buy now,” often times the train has already left. The only exception is if we think the increase in stock price is not substantial enough to reflect a drastic fundamentally positive change in the direction of the company. The same can be said of negative earnings reports. If a company’s reported earnings misses expectations and guidance is below par, and then the analyst downgrades the stock to a sell, what value does that add? The stock might have already dropped 5%, and our chance to sell at a better price would be gone.

This is just an example that we must do our due diligence and be mindful of the information available to us. Fundamentally, it is true that the company is doing better, but this is already reflected in the stock price. Considering the technicals of how a stock trades is important in deciding when to buy or sell. Even if we are investing for the long term, and day to day price movements do not matter as much, 5% or 10% could be a year’s worth of returns. Of course, there are certain analysts who publish great research reports, and give us insight to companies unavailable elsewhere. It is up to us as investors to interpret reports and recommendations to formulate our own investment thesis, not blindly take others’ recommendations. Even if those recommendations are sound, keep in mind that it is accessible to the public meaning inevitably, there are many others who already acted on the information, limiting returns for us. With that said, research reports with notable changes in recommendations that are published before earnings reports should merit attention. This is because most of the time, analysts are afraid the stick their necks out in fear of being wrong. It is much safer to follow the crowd and update models after earnings.

If the majority turns out to be wrong, it is safer to be wrong when everyone else is wrong, than to be wrong when everyone else is right. However, analysts who stick out from the crowd must have the conviction to risk his/her reputation to publish an uncommon perspective before earnings. This deserves attention, and while being different from the crowd doesn’t necessarily mean he/she is right, as investors, we can benefit from considering different perspectives.

Trends

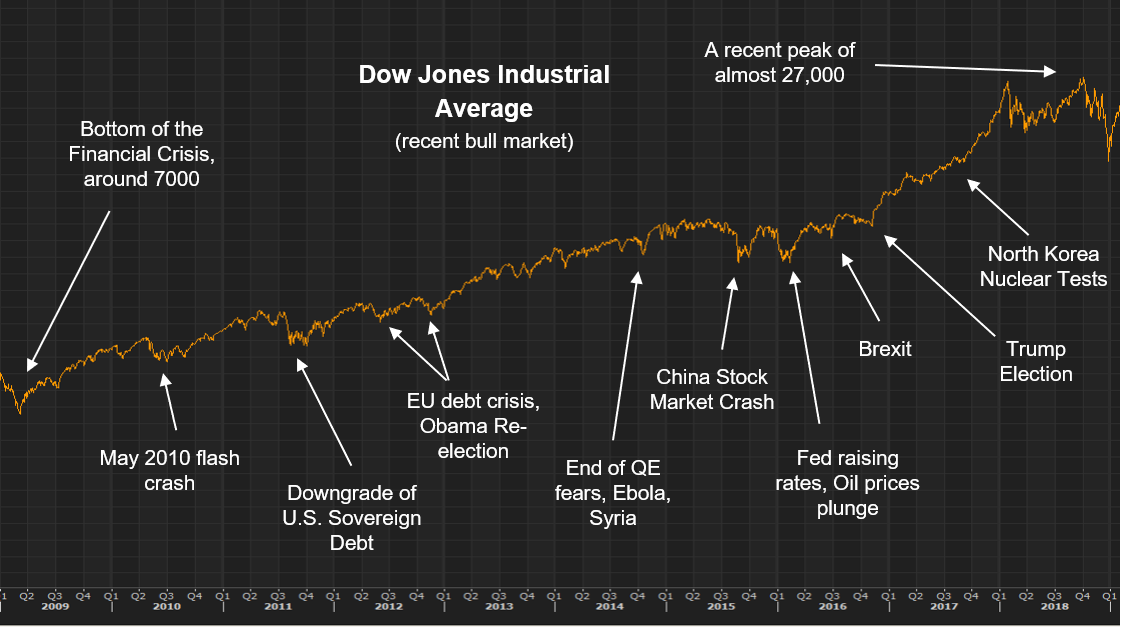

In the investing world, there is a saying that the trend is your friend. Most of the time, following long term trends stay intact, and it is not worth it to try to bet against them. In a bull market - a period when stocks are mostly in an uptrend - it would take some serious guts to bet against it. Of the hundreds of times that the market sells off in a bull market, only the last sell-off cannot be bought. Everyone who panicked in each little scare during a bull market misses out on attractive investment returns. Only when something fundamentally changes about the economy for the worse is it reasonable to bail. Of course we should never be inflexible as to follow only one track of thought, but for most of the time, the trend is your friend. Only in very special cases when we have the strongest of convictions with plenty of evidence to back it up should we consider betting against the trend. We encourage you to take a look at past market sell-offs, note the dates when they occurred, and try to find online financial news articles to gauge the mood at the time. Even though the underlying trend was still solid, the wall of worry sometimes take on a life of its own, getting more attention than it merits.

For single stocks, trends can be less effective tools than for the general market. Single stocks trade more with more idiosyncratic risk. Also, stocks of smaller companies can be more volatile - their shares are not traded as frequently as those of larger companies. Trends are a bit more predictable for large companies because there are many more investors who partake in trading than for smaller companies, which might be followed by fewer investors. Because of this, the market is more efficient in pricing stocks of large and frequently traded companies. A more efficient market means that trends have a better chance of being a reliable reflection of all available information. An established company with a great management team and sound fundamentals will likely continue its positive trend. However as with anything in investing, we need to do our due diligence and form our own thesis! If we are not willing to do at least a moderate amount of research, we are probably better off investing in an index fund, mutual fund, or letting a reputable investment professional do it for us.

Sensibility and Effectiveness

No strategy in investing is absolute. There are always exceptions. If there was such an effective strategy that everyone can use, everyone would be great at investing. Inherent in any specific strategy is a law of diminishing returns as more people participate in it. The more people that use a strategy, the more likely that the returns of that strategy is not as great as it once was.

While specific strategies do not work with the same effectiveness forever, there are certain guidelines and mindsets that can increase the probability of making successful investment decisions.

Risk Management

A good rule of thumb when it comes to risk management is: if you are losing sleep over an investment, you are probably taking too much risk. When we manage risk, we should be thinking calmly and with discipline. When we are worrying too much, we do not think clearly.

Containing FOMO

Fear of missing out, applies just as much to investing as our everyday lives. When we let FOMO take over, we make rash decisions that we might regret later on. Instead trying to chase the crowd, we should evaluate if an investment is really good for us. It is much harder to lose money and make it back, then wait a bit and look for a better opportunity.

Take a Break

When we do make a mistake, and our investment outcome turns against us, how should we manage the situation? Perhaps the best policy is just to take a break. If we set our risk-level correctly, we can go for a walk in nature, spend a day outside not thinking about investing at all. As a result, we will probably come back with clearer minds. After all, one day should not make or break an investment. And even if it did, so what? There’s more to life than turning money into more money anyways.

Common Sense

At the end of the day common sense will prevent us from taking on too much risk. It’s ok if we don’t make a 100% return on an investment… 20% or 30% would do wonders for our portfolio while controlling risk levels. Every once in a while, we need to sanity check ourselves to see if we are making decision that is at least somewhat reasonable. Our emotions of greed and fear can be stronger than we might think.

Review

At the end of the day, the investing process is not clear cut and formulaic. While fundamental valuation should be a foundation on top of which to build upon, it should not be the end all be all approach. Keeping in mind the technical aspects of how a stock trades is a useful tool to make sense of seemingly irrational markets. Not all technical or fundamental approaches will work all the time, which is why we need to keep a sound and reasonable mindset. In the next lesson, we will discuss our emotions in the investing process.