The Investment Thesis

Stock picking starts with formulating the investment thesis. It is the reasoning, methodology, planning behind an investment. It can be complicated or simple, but the main thing is that the investor is clear about his/her views, criteria, and trading plan for the investment. It is like any project or undertaking. The project will vary in complexity and its other characteristics, but the key thing is to have a clear goal, purpose, and game plan. We wouldn’t want to jump into the market not being prepared, and suddenly find ourselves feeling like lost in a maze.

Setup

Market Cycle

One of the prerequisites to forming an investment thesis is to know the setup that we want to start out with. First off, we should have a general idea of what part of the economic or business cycle we are in. This can be:

- Early Cycle - soon after a recession and just starting to recover.

- Mid Cycle - well into the recovery but not approaching full employment and inflationary pressure yet.

- Late Cycle - close to or at full employment and some inflationary pressure. Basically, things are so good, they can’t get that much better than they already are.

Market Sector

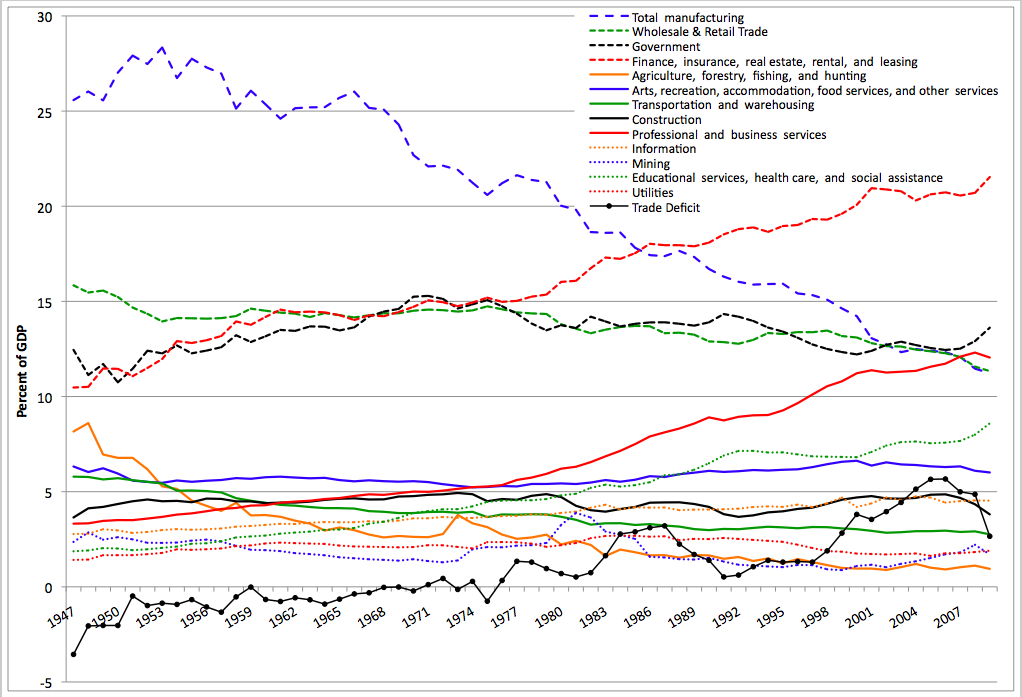

What sector or industry do we want to invest in? Do we want to focus on one sector that we are comfortable with, choose a few sectors, or diversify across many sectors? One good approach is to stick with the things that we know well. If we play video games, we might have a good perspective on what the electronic gaming world is like. If we practice medicine or do biology research, we might understand the healthcare sector more easily that most. Of course, just because we might work in an industry doesn’t mean that we are experts on the investability of the companies! We still have to do our research and due diligence on our investment decisions. We need to know what we know, and know what we don't know. Below is a graphic on the percentage composition of certain sectors in our economy over time.

Company Size and Type

What are the types and sizes of the companies we want to invest in? Do we prefer investing in growth companies with a really long term perspective? Or do we like the idea of value investing, on getting good deals on great companies at great prices? Do we prefer to invest in companies with small market caps or large market caps? Size is often correlated with maturity of the company, but there are plenty of large companies that grow at impressive rates!

Analysis

Valuation

When performing the in-depth analysis of our company, do we prefer a theoretical, model based approach like DCF? Or do we prefer using market multiples to gauge what the company should be worth compared to similar companies? Of course, there is no harm and much benefit to using both methods as a “sanity check” on each other.

Technicals and Sentiment

After we have done a fundamental valuation of our company and formed an opinion on what it’s worth, we need to consider the technicals. Is the current market environment and stock price an attractive opportunity? Is the current mood towards the stock and the general market positive, negative, or neutral? How long might this mood last, and are there any potential triggers that might change it in the near future?

Catalysts

Are there any company-specific events coming up that might affect the stock price? If so, what are the risk-reward profiles of entering into a position before the event or after the event? A company’s true value might not be realized for some time, so what might cause a change in that?

Trading Plan

Entry and Exit

What is our plan with regards to how we want to enter into a position or exit a position? Do we want to leg into it by buying small pieces over time, or relatively large chunks? For example if we have a low conviction, we might want to enter into our position in 5 separate chunks, buying 20% of a full position each time. If we have a very strong conviction, we might just want to start a 50% position, and then slowly add to it as we see fit.

The same applies to exiting a position. Instead of selling all at once, we might want to split it up somewhat to lower the risk that we get our timing wrong. Also, are there any price ranges or events that we want to watch out for that might prompt us to enter or exit a position?

Discipline and Emotions

As a safety net in case we get it wrong, how do we manage our emotions and stay disciplined so that we deal with the situation in an orderly way? While investing dynamics change, it might be good to write down a few conditions we want to remind ourselves of when we are in a challenging situation. Because our emotions when we enter a position will be different from what we feel in a challenging situation, having something down in writing can give us some perspective and help us minimize the impact of emotions in our investing decisions.

Review

Forming the investment thesis is the core of the investing process. Having a reliable methodology of how to go about making decisions makes a complex undertaking more manageable. Keeping a list of the important things to watch out for each time we want to make an investment will minimize the chances that in our excitement, we forget an important consideration. In the next lesson, we will discuss how you can actually get started with investing!