Self-Understanding

Throughout our investment careers, we will gain many types of technical experience. However, one of the most interesting things we will come across is what we learn about ourselves. Having a self understanding of how we deal with success and failure is part of the cool parts about investing as with other endeavors in life. Hopefully as we learn more about ourselves, we will also learn how to frame our investing process in a customized way to accentuate what we are good at and mitigate our shortcomings.

Choose Setup

Investment Vehicle

Similar to choosing a setup for our investment thesis, we need to choose a setup for our whole investing process at a more basic level. Through what type of platform or vehicle do we want to invest? If we want to manage our own finance, perhaps go for one of the major firms offering personal brokerage accounts like TD Ameritrade, Charles Schwab, and Fidelity Investments. If we want to leave the investing to dedicated portfolio managers, perhaps we can put our money in various types of funds. If we want a broader range of services for our personal finances, perhaps look for a financial advisor at a wealth management firm.

Asset Class

Next, we should decide what types of assets we want to invest in. Are we more interested in stocks and their growth potential? Or do we like the stability of fixed income investments? Do we want any exposure to real estate?

Investment Products

After deciding the platforms and asset classes we want to invest in, we should decide what types of products we want to work with. Most investors stay with the regular assets like stocks, bonds, and ETFs. If you are a risk taker and are in a position to handle more risk, want to learn more about derivatives, and are up for taking on a steep learning curve, maybe try out options.

Formulate Investment Thesis

In the previous lesson, we discussed exactly what a process for formulating an investment thesis might look like. It is the bread and butter of making investment decisions once we have the logistics set up. At this phase, hopefully the more mundane tasks for setting up brokerage accounts and other considerations are taken care of. Now it is all down to the investment analysis, execution, and reflect and improve over time.

Trial, Error, Reflect, Improve

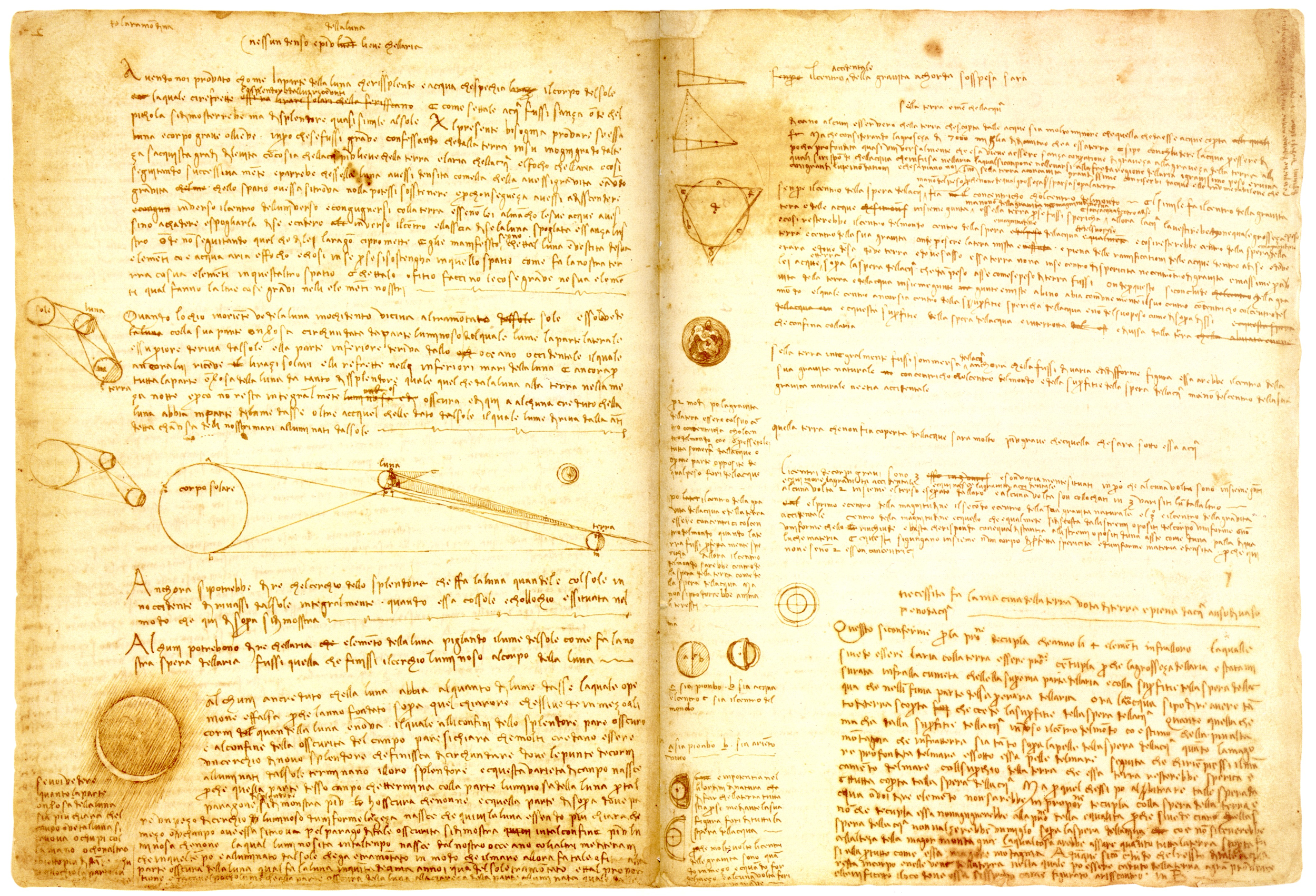

Investing takes a lot of work, and even the best still have things to learn. The investing process is not only analysis. Much of the undertaking is managing emotions, discipline, and improving over time. After some time, we will get to know our habits, tendencies, and types of mistakes we are prone to make. We will make errors in judgement, but the key is to not make it again, or at least too often. Our strategies will also change over time, as we tweak and revise them to achieve better, more consistent results. This process of revision and improvement is the basis upon which so many inventions and discoveries were made over the course of human history.

Good Luck!

We have reached the end of our series of lessons on investing, and we hope that you have learned much. If we are able to find for ourselves a simple, repeatable strategy and set up, it is not too difficult to profit from the compounding machine that is the stock market and American innovation. Lastly, remember that simplicity is efficient and effective. We hope you have learned lots and achieve your financial goals. Good luck investing!